PHOTO

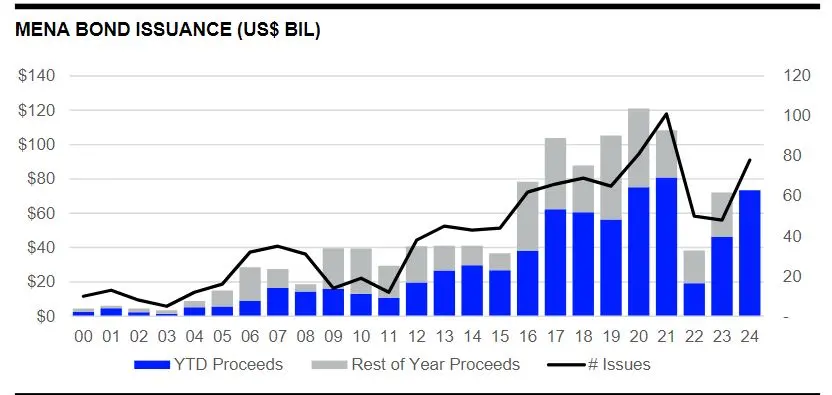

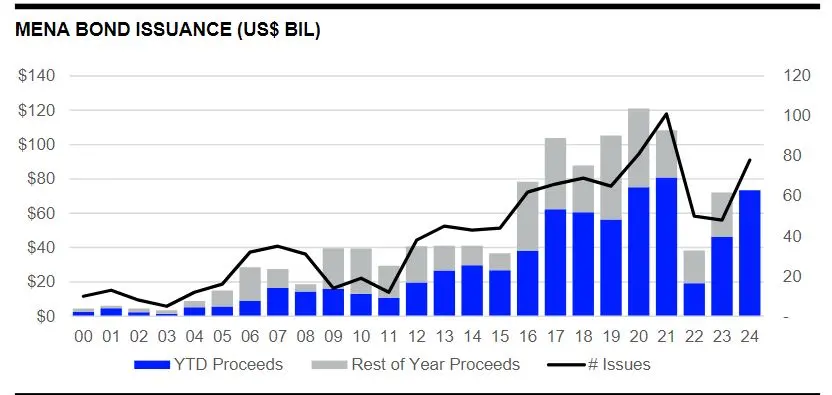

Bond issuance in MENA totalled $73.4 billion during the first half (H1) of 2024, 59% more than the value recorded during the same period last year, according to LSEG's Deals Intelligence.

This is the highest H1 total since LSEG's records began in 1980.

The number of issuances increased 63% over the same period.

Saudi Arabia was the most active issuer nation during H1 2024 accounting for 49% of total bond proceeds, followed by the UAE (29%) and Qatar (10%).

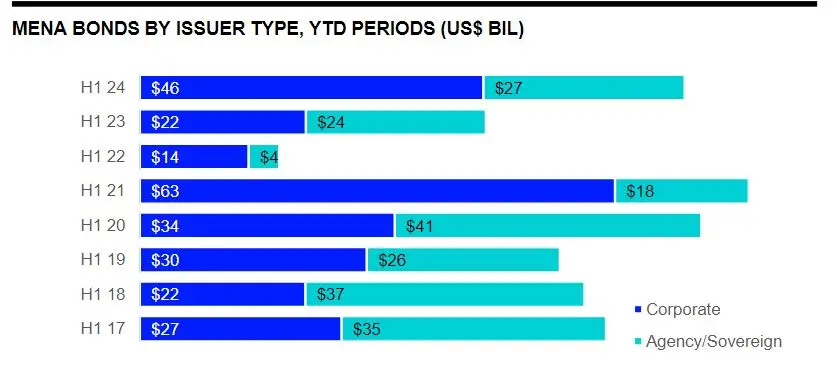

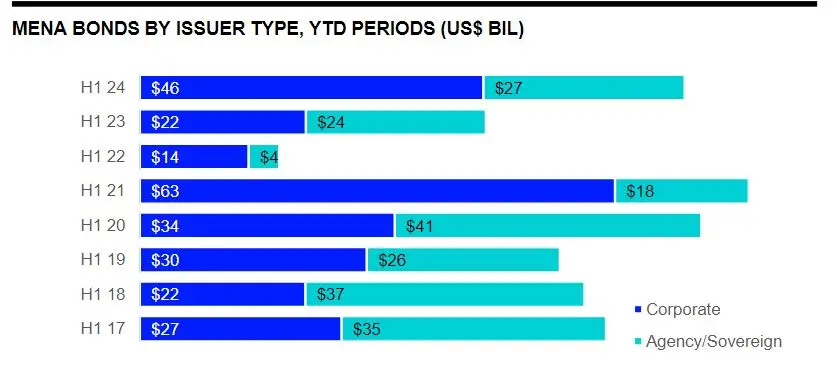

Financial issuers accounted for 56% of proceeds raised during the first half of 2024, while Government & Agencies accounted for 36%.

Islamic bonds in the region raised $27.6 billion during H1 2024, an H1 record

Saudi Arabia had the most sukuk issuances. KSA Sukuk Ltd. issued the biggest Islamic bonds of $4.96 billion. Saudi Electricity Sukuk Programme Co. was the second biggest with an issuance of $2.20 billion.

Sukuk accounted for 38% of total bond proceeds raised in the region, compared to 40% last year at this time.

Standard Chartered took the top spot in the MENA bond bookrunner ranking during the period, with $8.2 billion of related proceeds, or a 11% market share.

Standard Chartered also took first place in the MENA Islamic bonds league table followed by HSBC Holdings PLC.

(Reporting by Brinda Darasha; editing by Seban Scaria)