PHOTO

Environmental, social and governance (ESG) sukuk issuance, comprising green and sustainability-linked sukuk, was dominated by mostly GCC-based financial institutions in Q1 2022, though most issuances came from the energy and utilities sectors.

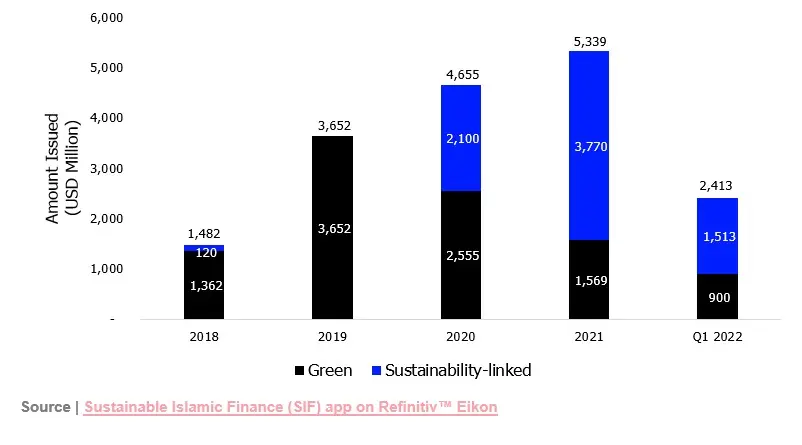

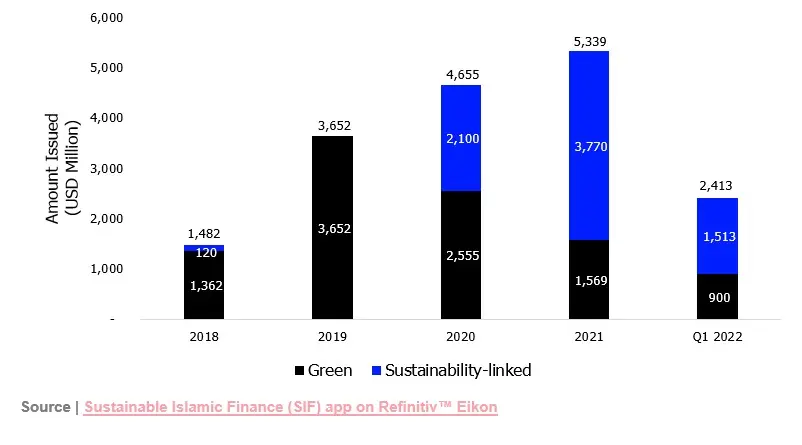

ESG Historical Sukuk Issuance 2018–Q1 2022

The issuance reached $2.4 billion in Q1 2022, slightly lower than the $2.5 billion issued during the same period in 2021, according to global data provider Refinitiv. The debut issuance of $900 million from Bahrain-based Infracorp, the infrastructure investment arm of Gulf Finance House (GFH), was the largest ESG sukuk issued during the quarter.

Two other debut issuances, also from financial institutions, came from Saudi Arabia; the Saudi National Bank and Riyad Bank issued sustainability-linked sukuk worth $750 million each.

The sukuk issued by Riyad Bank was the world’s first sustainability-linked Additional Tier 1 (AT 1) sukuk. The proceeds of the issuance are expected to provide Shariah-compliant financing and refinancing for certain sustainable projects, according to the Bank’s Sustainable Finance Framework. Saudi Arabia is the only Organisation of Islamic Cooperation (OIC) jurisdiction, and one of a handful in the Asian continent, with ESG AT1 sukuk.

GCC Sovereigns Tap ESG Debt Market Eyeing Broader Investor Base

ESG investment opportunities are rapidly emerging in GCC markets. Governments seeking to invest heavily in the renewables sector and corporates are incorporating ESG principles in their operations and financing, and this is set to reshape the region’s financial landscape.

Issuers in the region have also come under pressure from foreign investors, mainly from Europe and the US, to cater to demand for investments classified as “green” or “sustainability-linked”, which could eventually become a point of access for tapping international capital markets.

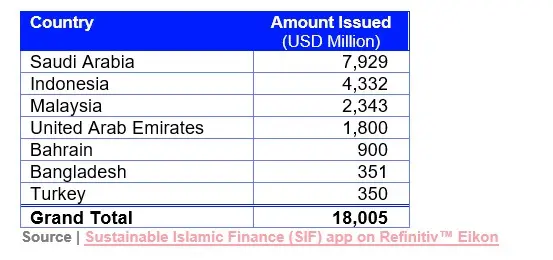

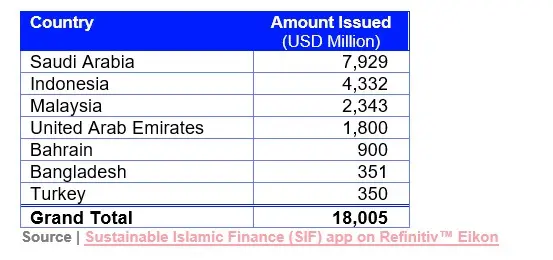

ESG sukuk issued by GCC-based entities, which began in 2018, has reached a total value of $10.6 billion, or 59 percent of cumulative global issuance up to Q1 2022. Saudi Arabia has now become the largest market for ESG sukuk, worth a total of $7.9 billion.

ESG Sukuk Issuance by Country 2017–Q1 2022

GCC governments will be making their debuts in ESG debt markets this year, with sovereign green issuances from Qatar and Saudi Arabia anticipated in 2022.

In March, Qatar’s Ministry of Finance announced the government’s plans to issue international green bonds, having held talks with lead arrangers back in January. “We don’t expect a big size, it’s going to be very small,” said Qatari Finance Minister Ali Al-Kuwari. “I think what’s more important than this is we need to build a vision and a strategy for climate change in the financial sector,” he added.

The Saudi government and the Saudi sovereign wealth fund, the Public Investment Fund (PIF), are also preparing to issue their debut green bonds this year, with the objective of diversifying and expanding their investor bases in addition to funding the Kingdom’s transition to a greener economy.

Some of the region’s regulators have also been working to incorporate ESG bonds and sukuk within their capital market regulations. The Qatar Financial Centre (QFC) launched the GCC’s first sustainable sukuk and bonds framework to further develop the local debt market.

“The aim of this framework is to encourage the further development of the local debt capital market by diversifying options for borrowers and investors and by laying a strong foundation for building trust between these stakeholders,” said QFC Authority CEO Yousuf Mohamed Al-Jaida.

The framework is based on the Green Bond Principles (GBP), Social Bond Principles (SBP), and Sustainable Bond Guidelines (SBG) of the International Capital Markets Association (ICMA). It focuses on promoting appropriate disclosures, the flow of relevant information, reporting, and transparency to ensure that ESG objectives are met and greenwashing risks are minimized.

Meanwhile, Oman’s Capital Market Authority (CMA) is developing its Bonds and Sukuk Regulation, which will also cover sustainable and responsible investments (SRI), including but not limited to social (waqf), sustainable, green and, for the first time, blue sukuk.

For more insights and analysis on the sukuk market size and trends, please visit Refinitiv Workspace/Eikon app, Sukuk Now.

(Reporting by Jinan AlTaitoon editing by Seban Scaria)