PHOTO

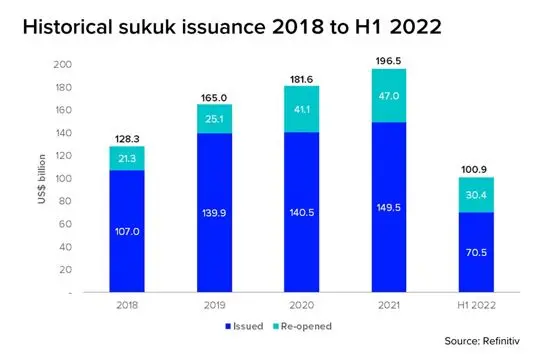

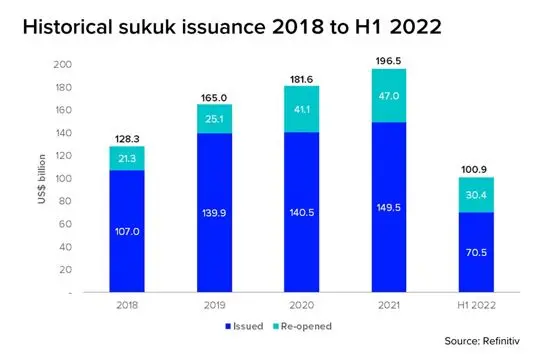

Global sukuk issuance reached $100.9 billion in H1 2022, however issuance momentum is slowing as the Fed leads a global monetary tightening cycle and elevated oil prices reduce government borrowing.

Refinitiv’s Sukuk Perceptions and Forecast Study 2022 provides an overview of the sukuk primary and secondary markets, highlighting the impact of recent economic and geopolitical developments that followed the relaxing of Covid-19 restrictions. Additionally, projections for sukuk issuance, market size and supply-demand gap are presented through Refinitiv’s proprietary Sukuk Supply and Demand Model.

The report also features the findings of the Refinitiv’s 2022 Sukuk Survey, shedding light on market perceptions of future growth, trends and continuing challenges facing both sukuk issuers and investors. 50% of respondents said that they are increasing the sukuk allocation in their Shariah-compliant investment portfolios in 2022, in light of ongoing economic developments. Over 50% of survey respondents cited strong demand for sukuk and diversifying sources of funding as important reasons for new sovereign issuers to tap the sukuk market. Meanwhile, 41% of respondents indicated they were still bullish about growth in global sukuk supply, expecting issuance to reach $180 billion or more in 2022.

Access the full report to find out more about:

- Up-to-date statistics and projections on global primary and secondary sukuk markets

- Recent developments and emerging trends in the sukuk market

- Various market players’ perception of prospects and challenges for sukuk