PHOTO

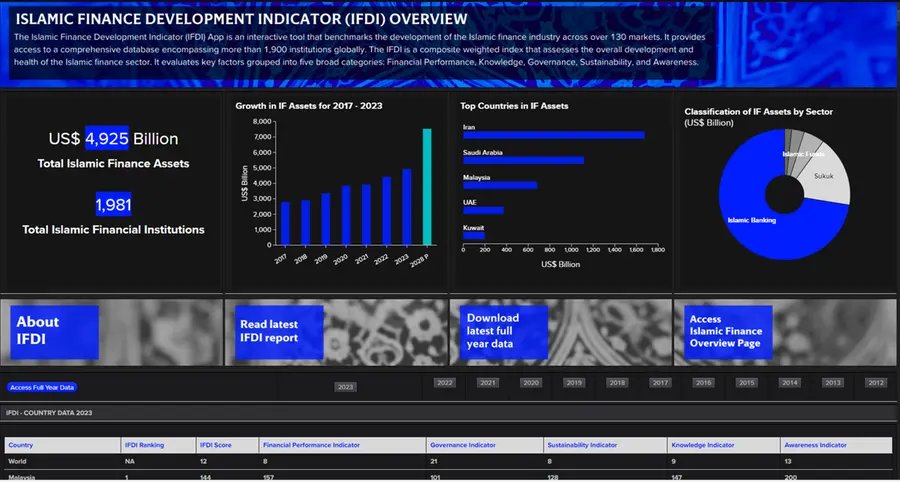

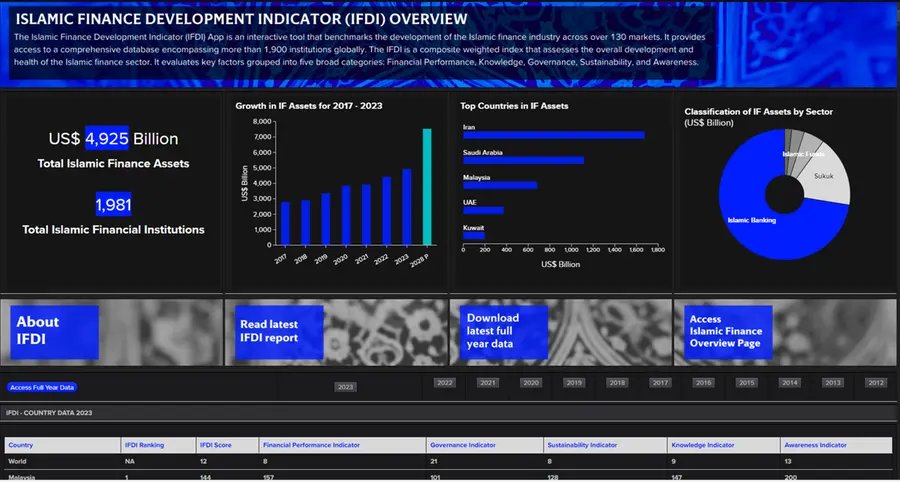

The Islamic Finance Development Indicator (IFDI) charts another strong year for the Islamic finance industry that was driven by an 11% growth to US$4.9 trillion in assets in 2023. Much of this growth is thanks to the continued commitment by different stakeholders that make up its ecosystem, including financial institutions, regulators and educators as noted across the report.

The IFDI report assesses the global industry's performance during 2023 and demonstrate the transformation of the Islamic finance industry in the decade from a niche market to mainstream in many countries and regions. The underlying indicator for the report drives the analysis from 136 countries statistics around the world across five indicators financial performance, governance, knowledge, sustainability, and awareness. We have also introduced some changes to the underlying IFDI model to better reflect the industry’s developments.

The report is launched in partnership with the Islamic Corporation for the Development of Private Sector (ICD) of the Islamic Development Bank Group.

Access the full report to find out more about:

- Up-to-date statistics on the global Islamic finance industry and its projected growth

- Main markets and trends impacting the Islamic finance industry

- Most-developed countries in Islamic finance according to IFDI 2024

Releasing the new IFDI Islamic Finance Database for 2023 - 2024

LSEG Workspace users can access the underlying data for the IFDI app. The database is comprehensive and can be downloaded in Excel book format with the details of every Islamic institution that discloses its financials.

The data includes over 1,900 Islamic financial institutions including Islamic banks and takaful operators along with sukuk, Islamic funds and Shariah scholars for different countries around the globe.

Click here to access the IFDI page and the global Islamic finance database in Workspace.