PHOTO

Climate financing needs in the Middle East and Central Asia region, could hit $3 trillion by 2030 according to new estimates, according to an IMF report released on the sidelines of the World Government Summit (WGS) in Dubai.

“According to estimates, $1 trillion will be needed to meet the financing needs for climate mitigation and adaption projects, but new estimates put that figure much higher – almost triple or $3 trillion,” said Jihad Azour, IMF’s Director of the Middle East and Central Asia Department.

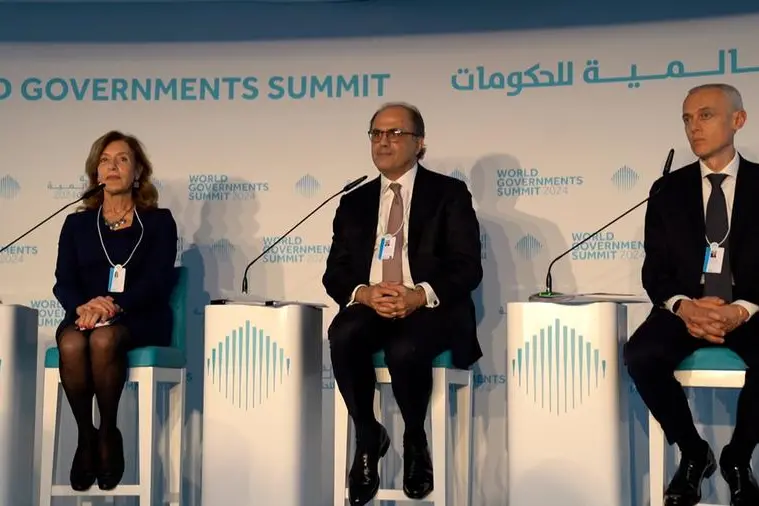

Azour presented findings of the new IMF report titled ‘Preparing Financial Sectors for a Green Future’, where he spoke about how banks would be able to manage risk through the support of climate related policies.

“Through our latest research, we have been able to project $50 billion in potential future credit losses that could impact the banking system of 30 countries in this region by 2050 should the current climate change trends persist,” said Azour.

The banking sector would feel the impact up to $140 billion in potential capital losses caused by exposures to carbon-sensitive sectors, which is equivalent to 2.5% to 5% of the region’s Gross Domestic Product, Azour further explained.

“If climate issues are not addressed, it can create pressure on the balance sheet of commercial banks. Over the last two years, different countries in the region have experienced a certain number of climate events. It is very important for the banking sector to develop capacity to understand the risks and create instruments and mitigate them and create buffers to anticipate those risks through policy making and strengthening the role of the insurance sector to mitigate such risks,” he added.

“Uninsured losses could further have impact on the profitability of banks, with 5% of profits affected,” he said.

In its latest regional economic update last month, the IMF revised its GDP growth forecast for the Middle East and North Africa region downwards to 2.9% this year, due in part to short term oil production cuts.

The IMF has recommended a ‘tailored approach’ in its report for the ME&CA region, recommending a phase out explicit energy subsidies, which could save $336 billion in the Middle East.

The report further mentions that even though green financing in ME&CA is ‘gradually increasing’, it remains small compared to the financing needs of the region, with developments largely concentrated in the GCC.

(Writing by Bindu Rai bindu.rai@lseg.com; editing by Daniel Luiz)