PHOTO

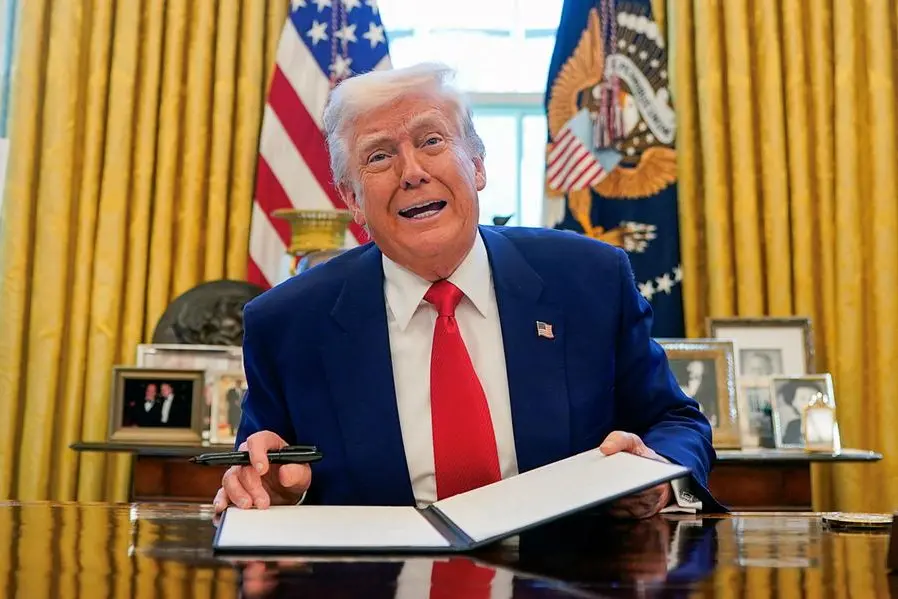

So the Trump put does exist and we have a measure for the US president’s pain threshold. The latter lies somewhere around the S&P 500 sliding 15% in less than one week, the dollar turning lower, and Treasuries starting to wear the weakness elsewhere.

We know this because the US backed away from its trade war, Trump announcing on his Truth Social platform a 90-day PAUSE on its tariffs programme for most countries, being those which have not retaliated so far, basically leaving China as the odd one out. Reciprocal tariffs have also been lowered to 10% over this period.

Granted there does seem to be some confusion here (!!!) given the baseline tariffs were established at 10% with the reciprocal tariffs being announced as targeted and increased additional measures last week, so President Trump does appear to have mixed up the names of his own programmes.

Regardless, one can fret that this is only a pause, and what will remain for Europe considering the reversal is specific for countries which have not retaliated against the shift toward a more hostile US trade policy, whilst Europe has in fact announced a targeted, albeit delayed, response of its own.

Leave that for another day because the S&P 500 soared 9.5% on the news, and who cares if S&Ps have slipped back more than 30 points or 0.7% through Asian trading?

Global bourses have followed suit; Eurostoxx50 futures are up 7.5%, and the Nikkei is up more than 8%, although the CSI300 is showing more moderate gains of 1.2%.

Treasuries are also finding relief, 10-year futures up ¾ point from their settle, but up a more slight 1/5 point from when Europe went home.

Bunds in contrast are getting smacked, down 120 ticks from their settle, although some allowance should be made for Treasuries getting hit after Europe’s close by Trump’s tariff reversal.

Long-dated JGBs meanwhile have had another wild ride, 30-year yields ranging from 2.58% to 2.81%, but the high fell just short of Wednesday’s high and the market is ending slightly lower on the day around 2.67%.

For all this good news, however, the dollar is slipping again, the index dipping to DXY102.57. The yen is stronger, at USD/JPY146.65, and so are the euro and the pound, at EUR/USD1.0991 and GBP/USD1.2865.

Gold is also bouncing, up to $3,115.69, flirting with last Friday’s highs, while oil is easing back after Wednesday’s big bullish engulfing, Brent crude down $0.76 at $64.72.

Today

Can we pretend it’s all over and the last month or so was just a bad dream?

To a greater extent, for the near term, we probably can. Riskier assets can continue to stabilise, and global markets can become more orderly again.

But such chaotic policy making will not be completely forgotten, and nor will the desire to completely shift the paradigm for international trade as well as to dismiss if not walk all over historical alliances.

If global markets were already losing liquidity amid so much volatility, then this aspect of trading is likely to get a little bit worse still today given the proximity of the US CPI report tomorrow. Heaven forbid a stronger print comes out (Reuters consensus +0.1% m/m and +2.6% y/y, +0.3% m/m and +3.0% y/y for core), which may be seen as restraining the Fed’s choices and highlighting the stagflation theme.

BNP Paribas meanwhile in its CPI Preview published on Tuesday afternoon wrote that it expects: “April CPI as the first potential data to reveal impacts from the administration’s auto and broader reciprocal tariffs.”

Granted, Trump’s reversal should prompt some relief here and potentially make the data somewhat outdated; why worry about tariff-driven inflation if the tariff threat has been reduced and delayed?

Yet decision makers, whether on a personal or a business level, will have already been framing their minds with respect to expectations for inflation, and this is to say nothing of what is likely to prove a greater and more lasting hit to confidence.

Back to today, however, and a bit of supply does feature as Spain will tap €5.5bn–€6.5bn of its 5/29, 10/32, and 4/35 bonds. Also, it will presumably be worth keeping in mind that Italy will proceed with its mid-month auctions Friday morning, when it taps €7.25bn–€9.0bn BTPs out to the 3/38 maturity.

Both auctions are at risk from bidders not wanting to participate amid so much global volatility. There are those – especially primary dealers – who have to participate, but they can be assumed to be wanting to run shorts into the auction process, and use the incoming paper to cover their positions, to the extent they may want to lighten their shorts.

Indeed, consider the “super-competitive” nature of the larger government markets in Europe, where dealers are having to chase client business in the secondary market and also chase auctions to keep their dealership going. Away from this, with respect to Spain at least, bidding is expected to come largely from Spanish accounts, although the non-competitive option is viewed as “super attractive” for fast money amid so much volatility.

Otherwise, the Spanish taps should go well amid reinvestment needs even if we aren’t particularly close to month-end; in this respect, note the auctions have been pushed forward a week (and come on the heels of last Thursday’s taps) in respect of Holy Thursday next week. Also helping are the chance to take down blocks of paper in a single showing (as auctions present a ‘liquidity event’), and interest in taking Spain as a proxy for less liquid markets like Portugal.

Cheaper valuations may also of course attract interest, but this is something of a double-edged sword given the cheaper valuations result from all the global volatility referenced above.

Source: IFR