PHOTO

Banks expecting stability and certainty following the election of Donald Trump are instead getting volatility, volatility and more volatility – the latest and most severe bout brought on by a trade war.

“The most important thing to me is the western world stays together,” said JP Morgan chief executive Jamie Dimon.

Economically and militarily the west needs to keep the world safe and free for democracy, Dimon said, hitting on the theme of his annual shareholders letter released earlier in the week.

“I don't care fundamentally about what the economy does in the next two quarters. That isn't that important. We've had recessions before,” Dimon told analysts on an earnings call.

“I would like to see the administration negotiate trade deals. I think they'll be good for everybody,” Dimon said. The administration must also focus on other parts of its agenda, such as easing regulation, which would free up capital and liquidity to finance the system, Dimon said.

“The economy is facing considerable turbulence [including geopolitics], with the potential positives of tax reform and deregulation and the potential negatives of tariffs and trade wars,” he said earlier in a statement.

Morgan Stanley chief executive Ted Pick chimed in too. “We are talking about the re-architecting of industrial policy in the context of America's place in the world, and where it wants to be decades from now. That is weighty stuff,” Pick said on the bank’s earnings call on Friday.

US president Donald Trump unveiled tariffs on virtually all of its trading partners on April 2, establishing a 10% base. The tariffs roiled bond and equity markets for the next week until Trump relented. But the trade war is not over: the 10% base is still in place and the US and China have hit each other with tariffs of more than 100%.

The hope is that the tariffs will be negotiated away or drastically curtailed.

In the meantime, market volatility has certainly impacted transactions and trading early in the second quarter.

“The stock, bond and currency markets are exhibiting the kind of overnight and intraday volatility that reflect rapidly changing probability assessments,” Pick said. “Given this unpredictability, some clients are deferring strategic activity while others are proceeding. Importantly, core segments of our client universe are continuing to engage.”

Dimon said the tariff story is different for every company. But for the most part it has essentially put a lot of corporate activity in limbo. "People not doing things," he said, referring to M&A hiring.

Barring the worst case, a total risk-off scenario, trade and geopolitical uncertainty will be priced into the market over time, Pick said.

“Now clearly, if we go risk-off… by definition then activity will stop,” he said.

So far Pick said his bank’s pipeline of deals has not been impacted by the policy uncertainty or market volatility. But that could change.

The issues at play are complex, intricate and unclear, he said.

"We are still very much engaged with clients. We're asking more questions as they are. We're listening to a wider spectrum of possibilities,” Pick said.

One thing is clear: “We're going to have higher structural volatility for a while,” he said.

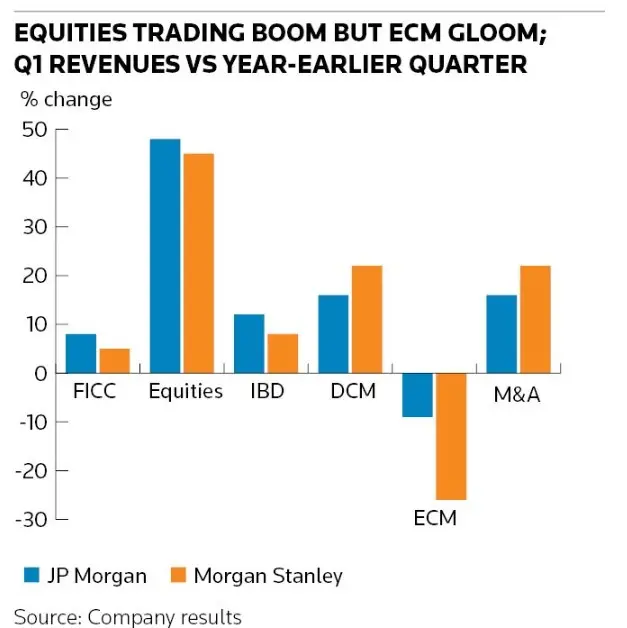

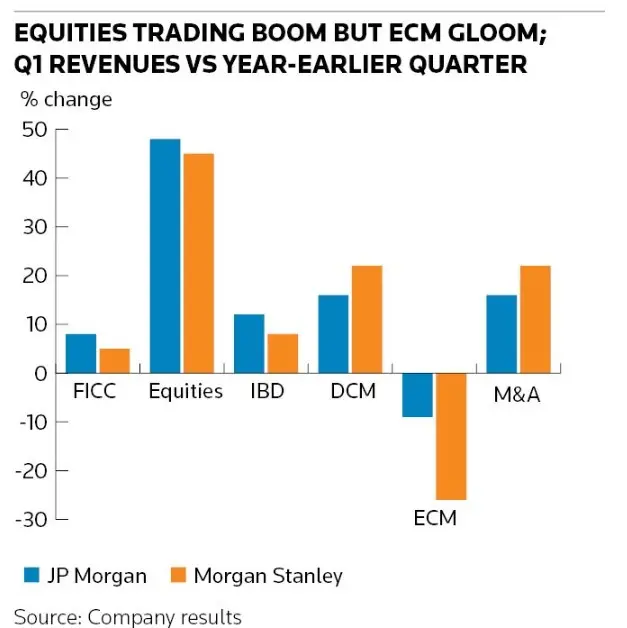

Economic uncertainty already had a mixed impact on the banks in the first three months of the year. JP Morgan and Morgan Stanley broke trading records for equity trading revenues as volatility encouraged activity. But fees from M&A advisory and equity capital markets remained in the doldrums as corporate bosses put off deal activity, and that is showing no sign of changing.

Source: IFR