PHOTO

Bahrain still needs to implement more fiscal reforms to put debt on a declining path. However, higher oil prices should provide some near-term fiscal relief and enable more support to the non-oil sector, Standard Chartered Bank said in a report.

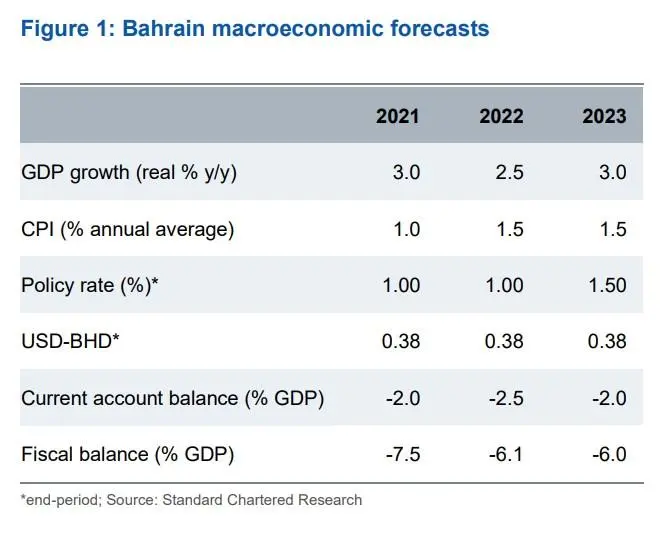

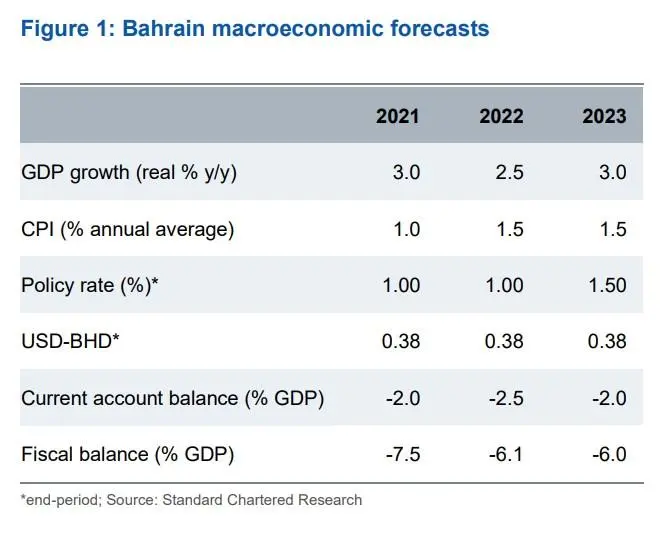

The bank has raised its 2021 growth forecast to 3 percent from 1.8 percent as the kingdom now expects a faster non-oil recovery in H2 supported by a fast vaccine rollout that is reducing coronavirus cases and helping businesses to recover, Standard Chartered Bank said in a report titled ‘Economic Outlook Q3-2021’.

Bahrain's economy contracted 2.11 percent in the first quarter from a year earlier, due to a decline in the non-oil economy as COVID-19 restrictions were in place most of the quarter, government data showed.

The non-oil economy contracted 2.97 percent, with the hotels and restaurants segment declining by 20.44 percent. The oil sector grew 2.04 percent in the quarter. Oil contributes more than 60 percent of the kingdom's revenue.

"While a resurgence in COVID-19 cases in H1-2021 and the subsequent reintroduction of restrictions weighed on growth, the economic impact is likely to have been milder than we had initially expected, with households and businesses adapting to the restrictions," the report noted.

"The improved liquidity position of GCC neighbours lowers the likelihood of slow GCC disbursements. These remain

key to Bahrain meeting its financing needs," it said.

A three-month extension of the government’s economic stimulus package, to August, should also help, the bank said.

Bahrain is also likely to return to international capital markets in H2-2021, following its January issuance, the report said, adding, while the extension of the economic stimulus package, estimated at $1.28 billion, will add to fiscal pressures, this should be partly offset by higher revenue.

The bank's 7.5 percent fiscal deficit forecast for 2021 remains unchanged.

(Reporting by Seban Scaria: editing by Daniel Luiz)

This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021