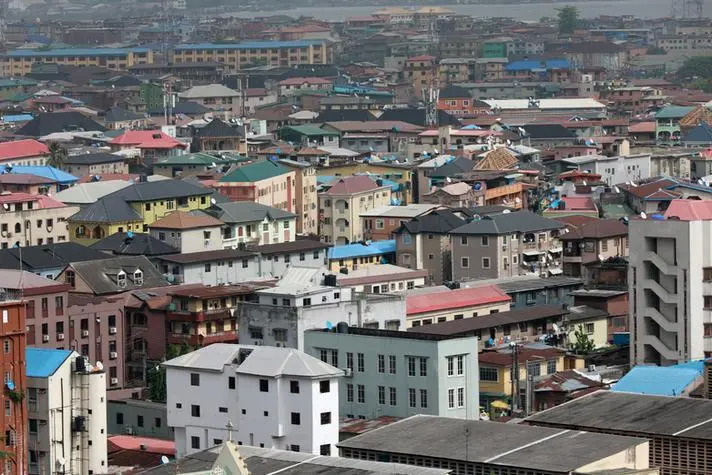

PHOTO

Nigeria has launched a programme to encourage savers to repatriate assets and invest them at home, Finance Minister Olawale Edun said, part of broader efforts to boost economic growth and counter foreign currency shortages.

Dollar shortages have been a major constraint on Nigeria's economy for years, disrupting imports and local companies reliant on foreign supplies.

Under the new voluntary disclosure scheme, which will run for nine months, anyone who declares "legitimate" foreign currency assets and puts them into the local financial system will not have to pay tax on any earnings from interest.

"The disclosure scheme is a bold initiative aimed at integrating foreign currency outside the formal financial system into the formal economy," Edun said in a statement late on Thursday.

"The scheme offers a secure, confidential channel for people to reintegrate their legitimate foreign currency funds, promoting stability and growth for our nation," he said.

As well as assets held abroad, the scheme will apply to Nigerians who hold foreign currency assets outside the formal financial system - for example, cash stashed in safety deposit boxes.

President Bola Tinubu is implementing a series of reforms aimed at kick-starting a sluggish economy stuck in low gear with growth of about 3%, short of the 6% annual expansion Tinubu targeted when he came to power last year.

The policies, which have been welcomed by investors, have included slashing subsidies on petrol and electricity and twice devaluing the naira currency within a year.

The government also hopes the disclosure programme will help curb illicit financial flows and increase tax revenue, though similar programmes in the past have not encouraged many people to declare their assets.

(Reporting by MacDonald Dzirutwe in Lagos; Writing by Elisha Bala-Gbogbo)