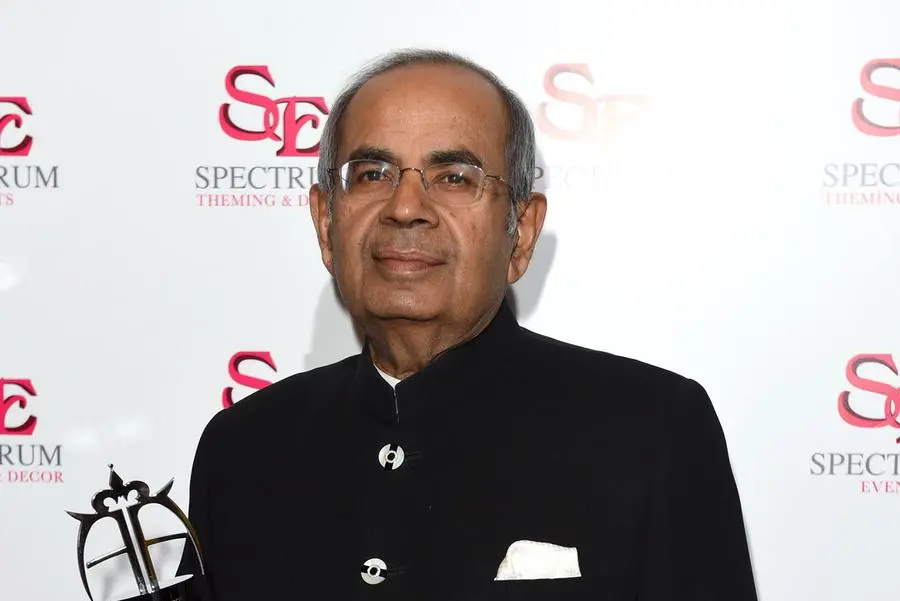

PHOTO

Indian billionaire Gopichand Hinduja has pledged to invest billions of dollars in Nigeria at a meeting with President Bola Tinubu who is in India for the G20 summit.

Tinubu met Hinduja, the Chairman and CEO of the Hinduja Group of Companies, shortly after arriving in New Delhi on Tuesday evening, Ajuri Ngelale, the president's special adviser on media and publicity said in a statement.

“We are here for business," Tinubu said. "I am here to personally assure our friends and investors that there is no bottleneck that I will not break. Nigeria will become one of the most conducive places on earth to make good profits."

Since his inauguration in late May, Tinubu has introduced sweeping reforms in Africa's biggest economy, pledging to revamp the country's economy and standing globally. "We are open for business,” he told Hinduja.

Apart from attending the G20 Summit, Tinubu will meet numerous business leaders from various sectors in India, and hold bilateral meetings with the leaders of India, South Korea, Brazil and Germany.

Hinduja - head of a business conglomerate with holdings in banking, chemicals, software, and commercial vehicles in India - said he had confidence in Tinubu having seen his previous performance as the governor of Lagos state, where Nigeria's commercial capital of the same name is located.

“We believe in you as a leader who has done this before," Hinduja said.

"You know what the challenges are. You know how to fix them. We are going to make investments into the billions of dollars under your leadership because we see you are already addressing the systemic problems."

Hinduja said he was ready to sign an agreement and to begin investing in Nigeria, which would be particularly focused on bus and automobile manufacturing in Nigeria.

The president has since his inauguration in May introduced bold reforms including removing currency controls. The decision resulted in an instant 40% devaluation of the naira. The loosening of exchange regulations is intended to increase capital movements and help clear a backlog of dollar demand that has accumulated over the years.

(Editing by Seban Scaria seban.scaria@lseg.com)