PHOTO

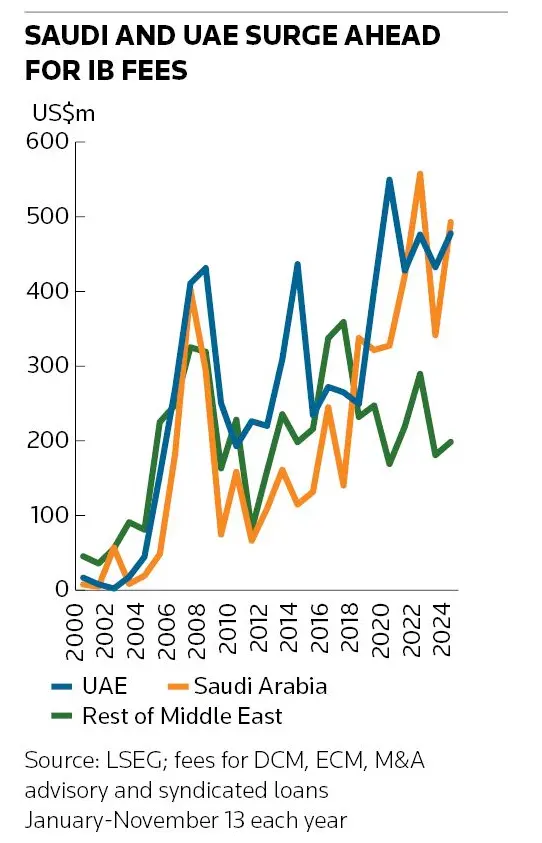

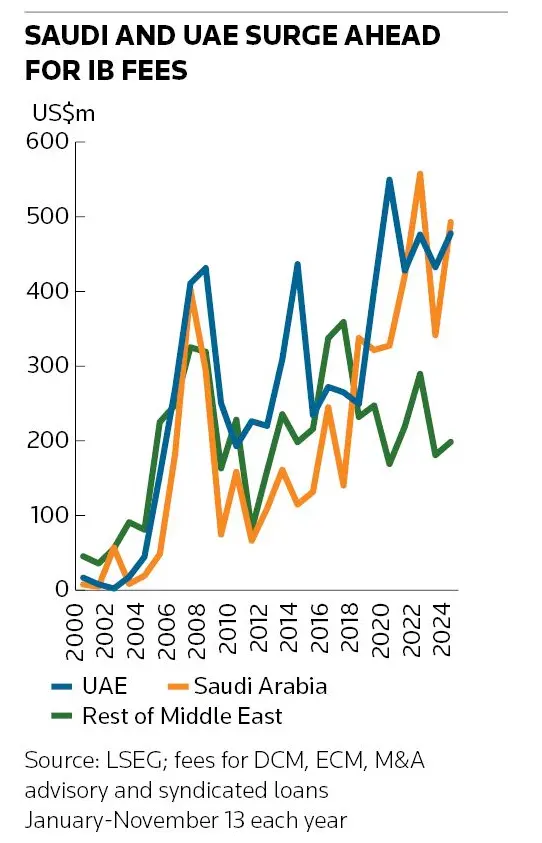

Saudi Arabia and the United Arab Emirates are in another tight race this year to be the top Middle East country for investment banking fees on the back of a surge in debt underwriting and robust IPO activity. And bankers said as competition heats up between the two, it has spurred progress in each market's development.

Saudi continues to put pressure on major banks and other firms to move their regional headquarters and top executives to the country rather than Dubai or elsewhere, senior banking sources told IFR. They said firms are often told it is necessary to win business in the country.

Indeed, Citigroup on Friday announced it had received approval for a regional headquarters licence from Saudi Arabia's Ministry of Investment. It said the licence was an important step and demonstrated the bank's commitment to the kingdom and its "economic growth and transformation".

"Saudi is using a stick because they have so much business to do they want people to be based in Riyadh rather than have suitcase bankers come in,” one senior banker said.

Still, firms are bulking up in the UAE, including banks, infrastructure funds, private equity firms and alternative asset managers. Several bankers said people are still more attracted to Dubai and Abu Dhabi than Riyadh, where many professionals are still reluctant to relocate, despite significant social reforms.

Last week, BlackRock said it had obtained a commercial licence in Abu Dhabi and plans to operate in its international financial centre, just weeks after announcing it would set up its regional HQ in Saudi. There has also been a big rise in hedge funds moving to Dubai to tap investment opportunities in the region and its huge sovereign wealth funds. Dubai International Financial Centre said Eisler Capital and Aster Capital recently arrived and it now hosts 60 hedge funds.

“Wind at their backs”

Saudi is on course to eclipse the UAE for investment banking fees in 2024, and both are ahead of all other countries in the region.

Investment banking fees – debt and equity underwriting, M&A advisory and syndicated loans – in Saudi were US$493m to November 13, up 44% from a year earlier and behind only 2022 as its best year at the same stage, according to LSEG data. The fees are 68% above the 10-year average at the same stage.

Fees in UAE were US$478m, up 10% from a year earlier, and the best year other than 2020. Its tally is 27% above the 10-year average to mid-November, LSEG data show.

“They have both grown meaningfully in the last five years and they have the wind at their backs,” said a senior executive in the region at a major Western bank.

He said rapid development of Saudi’s equity market around 2015–2018 and progress in its debt market sparked a reaction in the UAE during and after the pandemic to enhance its appeal. “There has been a change in mindset in terms of capital formation. And the competition drives progress for everyone,” he said.

Total fees across the Middle East were US$1.17bn through November 13, up 22% on the year and the second-best year at the same stage behind only 2022, with fees from Oman, Bahrain, Qatar and Kuwait adding to the tally – albeit all well behind the top two.

That’s good news for local and overseas banks. The top two banks for Middle East fees this year are HSBC and JP Morgan but First Abu Dhabi Bank is third, ahead of Standard Chartered, Citigroup and Morgan Stanley in the top six, and another eight MENA-based firms are in the top 20, LSEG data show.

Standout deals this year in Riyadh have included Saudi Aramco’s return to international debt markets in July after a three-year absence with an upsized US$6bn triple-tranche transaction, IPOs and a US$1.6bn rights issue for Savola. The sovereign Public Investment Fund also this month sold a US$1.03bn stake in Saudi Telecom, which is the market's largest accelerated bookbuild and is seen as evidence of the market maturing.

Banks are keen to broaden capital market products, and bankers said Saudi Arabia could develop its securitisation market, potentially for RMBS, and the repo market for debt instruments. Bankers also expect increasing focus on equity derivatives, such as for single stock options or futures for equity indices.

Highlights in the UAE in recent months have included the listings of technology platform Alef Education and supermarket chain Lulu Group, while Delivery Hero's local online delivery firm Talabat is set to list in a US$1.5bn Dubai IPO next month.

Vision of debt

Bankers said competition between Saudi Arabia and UAE's capital markets is intensifying as both want to build their financial hubs as part of growth ambitions and diversification away from oil. Saudi’s Vision 2030 strategy, which launched in 2017, has its Financial Sector Development Program at its core, which includes “the formation of an advanced capital market”.

Those ambitions have sharpened focus on capital structures and accessing equity and debt markets for government-related entities and private sector firms, bankers said.

Firms are being encouraged to issue more debt so they are less reliant on bank loans, and that has been evident this year. DCM fees in the Middle East were US$363m through mid-November, up 68% on last year and 56% higher than the previous record in 2021. Saudi has accounted for US$156m of this year’s DCM fees, up 46% on last year, and fees from the UAE were US$131m, up 35%.

Even with that rise, several bankers said DCM is ripe for strong growth as they advise investment-grade and mid-sized firms on debt requirements and ratings processes, and introduce new products.

A target of Vision 2030 is for the volume of debt instruments in Saudi to increase to 24.1% of GDP by 2025 from 14% in 2019. The country also launched a primary dealer programme in 2018 with five local firms, including Saudi National Bank and Saudi Awwal Bank, part-owned by HSBC. In 2022, they were joined by BNP Paribas, Citigroup, Goldman Sachs, JP Morgan and StanChart.

Equity issuance has also been a bright spot in the Middle East and ECM fees were US$308m through to November 13, up 53% from a year earlier and continuing a big step-up since 2021, in contrast to mostly lacklustre IPO activity elsewhere.

Some US$168m of those fees have been from Saudi, double the year-earlier level and putting it on course for its second-best year after 2022. ECM fees in the UAE were US$98m, below the level at the same stage of the past three years.

Saudi’s equity market is regarded as the most developed and mature in the region, and was given a big boost by the record IPO of oil giant Aramco in 2019, which deepened liquidity and set the Tadawul market up for a raft of subsequent listings from state-owned and private issuers, which have mostly attracted strong demand and performed well in the aftermarket. The UAE is increasingly catching up with a greater diversification of issuers, although private sector aftermarket performance has lagged that of state-backed deals.

Bankers said while capital markets are expected to continue growing in Saudi and UAE, the former could open a lead in the medium term thanks to the benefit of scale – a population four times the size (37 million people versus 9.5 million), double the GDP and a geographic size 25 times its rival.

While both are keen to develop many of the same industries – including renewables and energy transition sectors, property, chemicals, logistics and transport – much may depend on their growing ambitions in technology and digital infrastructure, as shown by the June listing of insurance fintech Rasan in Riyadh and the upcoming IPO of Talabat. There is also talk that an IPO for Abu Dhabi's Etihad Airways could take off in 2025.

Source: IFR