PHOTO

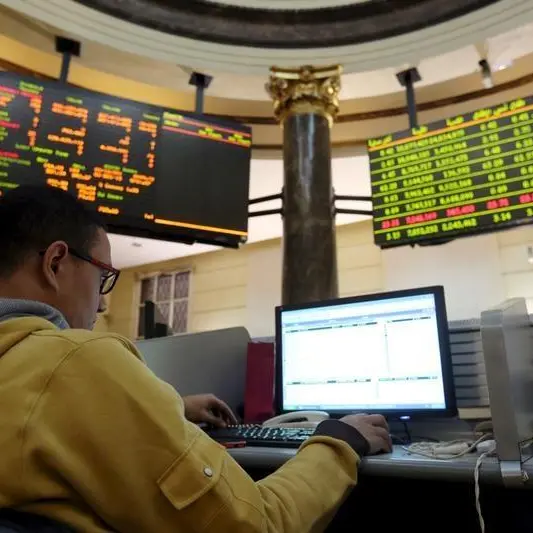

Stock markets in the Gulf were subdued in early trading on Thursday in tandem with global peers after the U.S. Federal Reserve signaled a slower pace of rate cuts in the coming year.

Most central banks of the Gulf Cooperation Council cut key interest rates on Wednesday, following the Federal Reserve's decision to reduce U.S. interest rates by a quarter of a percentage point.

The Fed cut was expected, but Powell's explicit references to the need for caution from here on sent markets into a tailspin.

Saudi Arabia's benchmark stock index .TASI was down 0.4%, pressured by losses in most sectors. Al Rajhi Bank 1120.SE, the world's largest Islamic lender, fell 1.6% and Almarai Company 2280.SE lost 2.1%. Saudi Arabia's largest dairy producer, Almrai, said its board has approved full-year cash dividend of 1 riyal per share.

Shares in United Electronics 4003.SE rose 2.7% after consumer electronics retailer said its board has proposed to buy-back upto 3 million shares and also decided to distribute 5 riyals per share as exceptional cash dividends for fourth quarter.

Dubai's benchmark stock index .DFMGI slipped 0.1%, pressured by losses in real estate and consumer staples. Emaar Development EMAARDEV.DU lost 2.7% an Dubai Financial MarketDFM.DU, the operator of Exchange, dropped 2%. Emirates NBD ENBD.DU, however, gained 1.5%.

Dubai's largest lender, ENBD said Wednesday it and Abu Dhabi Islamic Bank have closed £140 million club deal for student accommodation in London.

The Abu Dhabi benchmark index .FTFADGI fell 0.2%, weighed down by a 1.6% loss in ADNOC Drilling ADNOCDRILL.AD and a 0.6% drop in Abu Dhabi First BankFAB.AD, the UAE's largest lender.

Gulf Pharmaceutical Industries JULPHAR.AD climbed 4% after the pharmaceutical manufacturer has sold its subsidiary DiabTec.

* Qatar Stock Exchange was closed for a national holiday

($1 = 3.6727 UAE dirham)

(Reporting by Md Manzer Hussain, Editing by Angus MacSwan)