PHOTO

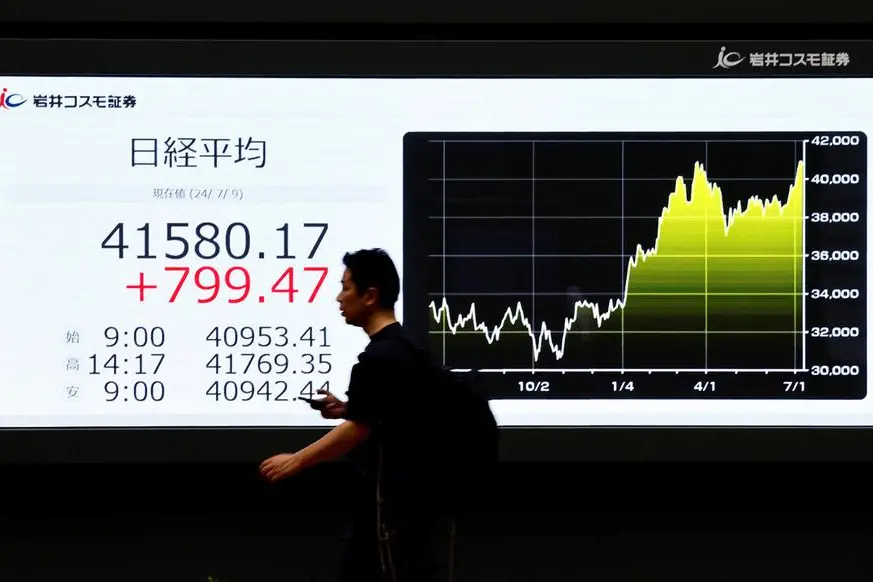

TOKYO - Japan's Nikkei share average reversed course to end higher on Thursday after two straight sessions of losses made stocks relatively cheaper.

The Nikkei gained 0.56% higher to close at 38,349.06, after dropping as much as 0.87% earlier in the session.

The broader Topix climbed 0.82% to 2,687.28.

"We saw little market-moving cues today, but investors wanted to buy back cheap stocks. Even shares in Toyota rose despite a stronger yen," said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory.

"Japanese stocks are cheap relative to U.S. stocks."

Toyota, which fell 2.2% this week, added 1.4%, while peer Honda Motor gained 0.5%.

Chip-making equipment maker Tokyo Electron jumped 6.74% to lend the biggest boost to the Nikkei.

Wall Street's main indexes closed lower on Wednesday, with the Nasdaq leading the declines, as technology stocks slumped on worries that the Federal Reserve might be cautious about rate cuts after stubbornly strong U.S. inflation data.

The yen advanced 2.4% this week and recovered losses suffered since the U.S. presidential election. But the Japanese currency has weakened through the Asia session, trading down 0.33% to 151.585 per U.S. dollar.

A stronger yen tends to hurt the shares of exporters as it decreases the value of overseas profits in yen terms when firms repatriate them to Japan.

The yen's strength drove expectations that the Bank of Japan (BOJ) might not raise its policy rate at its December meeting, which was positive for local equities, said Suzuki.

Just over half of the economists surveyed in a Reuters poll expected the BOJ to raise interest rates again next month as a strengthening economy and concerns over the depreciating yen prompt policymakers to act.

Chip-testing equipment maker Advantest fell 3.48% to weigh on the Nikkei the most.

(Reporting by Junko Fujita; Editing by Abinaya Vijayaraghavan and Sumana Nandy)