PHOTO

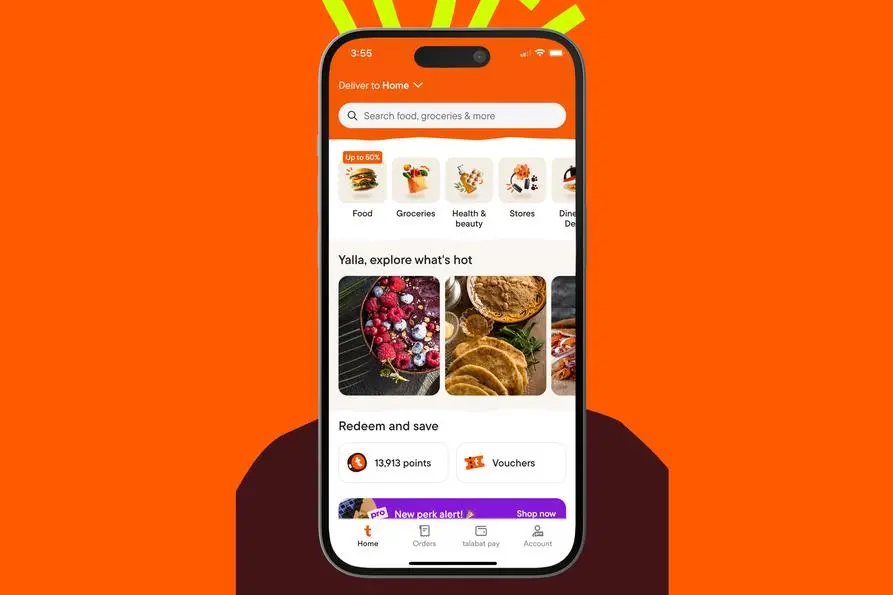

Delivery Hero has set the price for the IPO of its Middle Eastern unit, Talabat, at 1.60 UAE dirhams ($0.44) per share. It will raise AED 7.5 billion ($2 billion) in gross proceeds from its IPO on the Dubai financial Market (DFM).

The offer price is at the top end of the previously announced price range, implying a market capitalisation of AED 37.3 billion ($10.1 billion) at the time of listing.

Earlier this week, Talabat upsized its offering to 20% from 15% of the company’s total issued share capital, equivalent to 4,657,648,125 shares, following significant investor demand.

Talabat IPO is likely to be the UAE’s biggest listing of the year after increasing the offer size. Hypermarket chain Lulu Retail raised $1.7 billion by floating a 30% stake in ADX last month in the UAE’s largest IPO this year to date.

Talabat said the offering achieved a double-digit oversubscription level.

Allocation of the first tranche will be on 6 December, 2024, with refunds to commence from the same date.

The shares are expected to start trading on the DFM on 10 December, 2024.

Emirates NBD Capital PSC, J.P. Morgan Securities PLC, and Morgan Stanley & Co International PLC acted as joint global coordinators and joint bookrunners.

(Writing by Bindu Rai, editing by Seban Scaria)