PHOTO

The dwindling buying power of consumers, owing to slow economic growth, is adversely affecting trading companies and putting pressure on average industrial rents in the UAE. Though rents have plunged in the first two quarters of 2019, this is seen as an opportunity for firms to scale up their businesses.

Average headline industrial rents have softened in Abu Dhabi and Dubai by 12.1 per cent and 4.8 percent respectively in the first two quarters of 2019, according to global real estate consulting and research firm Knight Frank.

The country will continue to be the regional hub for industries. “Initiatives by the government to ease regulations in the UAE will ensure that its regional hub status as an industrial and logistics hub stands firm in the face of increasing competition from regional peers,” said Matthew Dadd, Partner at Knight Frank.

The slowdown in the UAE’s industrial rents is a sign of maturity due to fundamental changes which are currently affecting the industrial and logistics sector.

“First, as the practice of dual licencing - where companies registered in a free zone could operate outside the zone - becomes more prevalent, we are beginning to see greater levels of consolidation in the market as occupiers look to increase the efficiency of their real estate portfolios by investing in one office – either inside the free zone or outside the zone,” the report noted.

“Given general market conditions, occupiers are using this as an opportunity to upgrade to higher specification units that comply with the standards borne in leading industrial centres,” said the research report, adding, “Due to these conditions, take-up from new entrants has been limited.

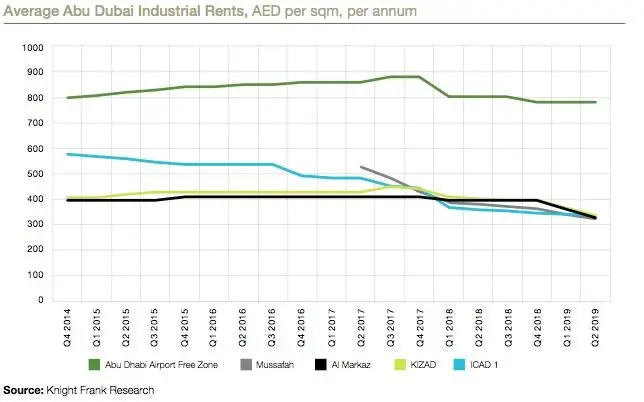

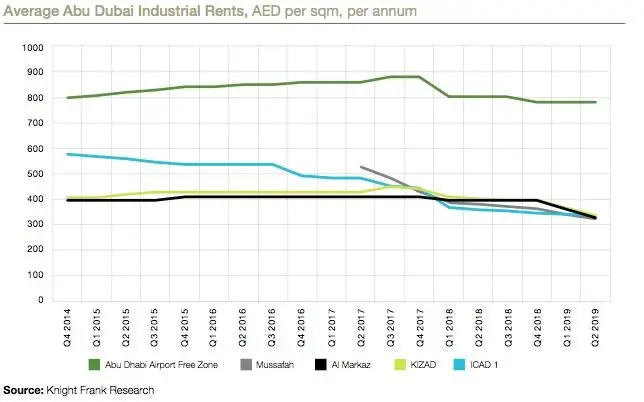

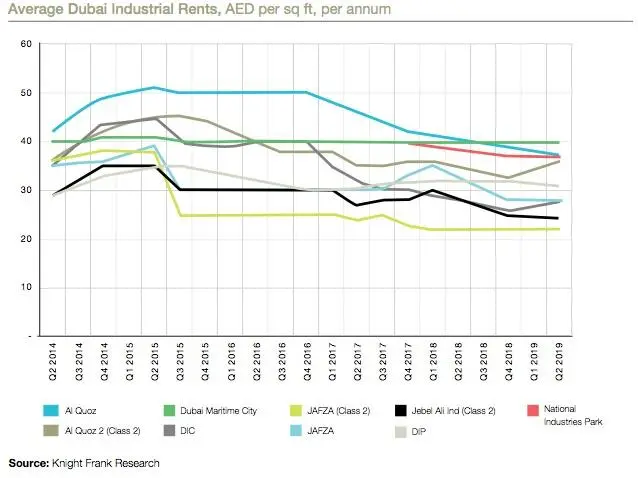

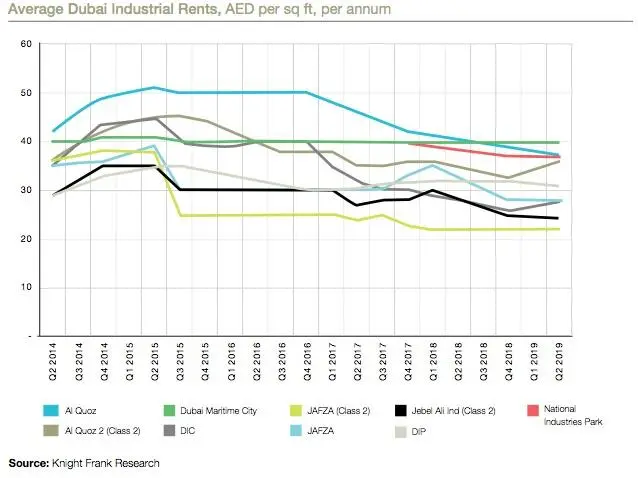

In both Abu Dhabi and Dubai, Knight Frank has seen a two-tiered market continuing to operate where rents for Grade B stock (located in less developed areas) continues to fall at a faster pace compared to Grade A stock (located in fully developed areas).

In Abu Dhabi’s secondary locations such as Al Markaz rents fell by at 18.4 per cent on average in the 12 months to June 2019. Grade A locations such as Abu Dhabi Airport Free Zone performed better comparatively with rents falling marginally by 2.5 per cent, it said.

Image 1: Average Dubai industrial rents. Source: Knight Frank

“A similar trend has also been witnessed in Dubai, however due the demand and supply imbalance, Grade A rents have seen material declines. According to Dubai Statistics Centre, new industrial licence issuance increased by 9.7 per cent in 2018, with renewal of existing licences remaining relatively at 0.4 per cent and cancellation of industrial licences recording a 5.2 per cent increase over the same period,” the report noted.

Due to the lack of demand and decisions by occupiers to vacate Grade B units which are no longer fit for purpose, Knight Frank found that rents in areas such as JAFZA and the Jebel Ali Industrial area soften over the last year. Rents currently stand on average at AED 28 and AED 24 per square foot, per annum, respectively.

Image 2: Average Abu Dhabi industrial rents. Source: Knight Frank

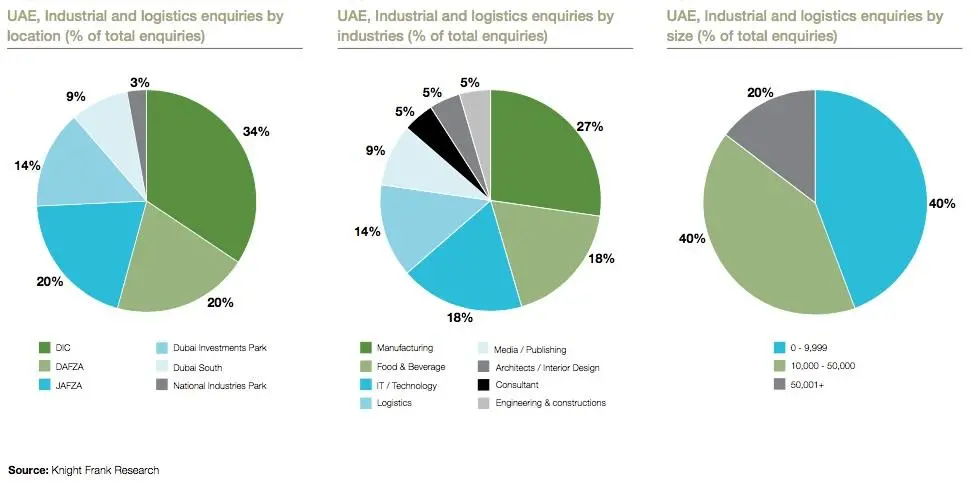

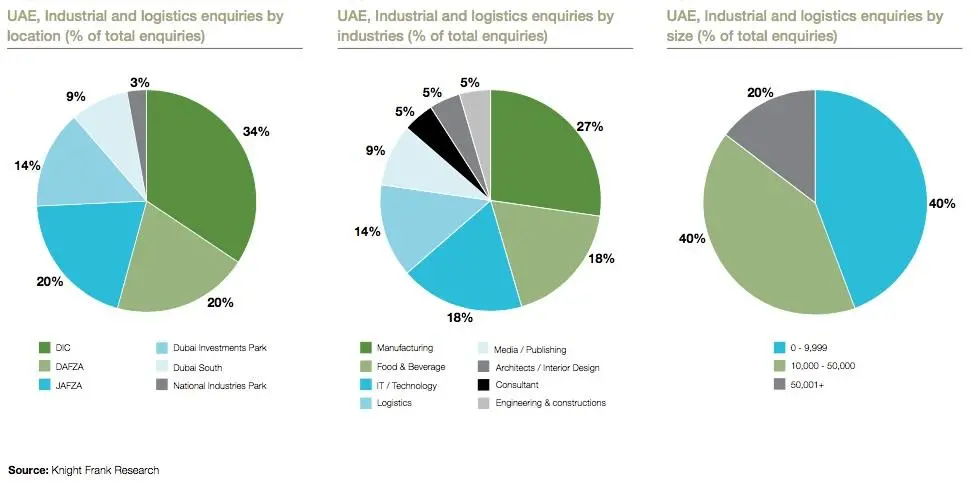

In terms of sectors fuelling industrial rents, the research firm says the manufacturing companies take the cake. Demand in the industrial and logistics sector in the first two quarters of 2018 was driven by manufacturing firms, which accounted for 27 per cent of total enquiries. The Food and Beverage and IT/ Technology sector accounted for over 18 per cent of total enquiries each. Logistics firms continue to be a strong source of demand with 14 per cent of total enquiries.

Knight Frank data shows that more than 74 per cent of total enquiries in the six months to June 2019 required space in Dubai Industrial City, DAFZA or JAFZA. Dubai Investments Park and Dubai South complete the list of top five most enquired locations.

Over the first two quarters of 2019, 40 per cent of enquiries have been for floor space of up to 10,000 square feet. Another 40 per cent of enquiries demanded floor space of over 10,000 and up to 50,000 square feet. Demand for large units of over 50,000 square feet remains low with 20 per cent of enquiries requiring space on this scale, said the report.

Image 3: UAE industrial and logistics enquiries. Source: Knight Frank

Assessing the future, Knight Frank said the outlook for the industrial and logistics sector is expected to be challenging over the short to medium term. While landlords will feel the pinch of reducing rents, consolidation of firms is on cards.

“As regulatory changes feed through the system we are likely to see consolidation continue with firms looking to optimise their real estate portfolios. This trend is likely to affect Grade B on-shore locations the most. Landlords will have to be willing to take sizeable reductions in rents in order to remain competitive, particularly in an environment where we expect Grade A rents to continue softening.

A more subdued market is likely to lead to further pressure on rents, which Knight Frank expects will continue to soften across the UAE in the short to medium term. “We may begin to see some moderation in this trend, if regional consumer confidence and consumption strengthens, leading to a flight to quality,” said the research firm.

(Writing by Atique Naqvi, editing by Seban Scaria seban.scaria@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019