PHOTO

Oil prices

Oil prices rose on Wednesday after a senior State Department official said on Tuesday that the United States has told countries to cut imports of Iranian oil to zero from November.

Supply disruptions from Libya and Canada have also helped boost prices.

Brent crude futures were at $76.60 per barrel at 0111 GMT, up 29 cents, or 0.4 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures were at $70.79 a barrel, up 26 cents, or 0.3 percent.

“Oil prices were flying higher overnight after catching an updraft from the U.S. administration calling for allies to cut Iran imports to zero tolerance,” Stephen Innes, head of trading for Asia-Pacific at futures brokerage OANDA, told Reuters.

“Libya will continue to be a significant point of concern in the oil supply chain,” he warned.

For North America, Innes said “the market continues to focus on Syncrude Canada where 350,000 barrels per day (bpd) remain in limbo after a transformer blew and shut a critical oil sands upgrader on June 2”. He added that repairs would likely last until the end of July.

Global markets

Asian shares dropped on Wednesday as trade tensions between the U.S. and China continued to weigh on markets.

MSCI’s broadest index of Asia-Pacific shares outside Japan lost another 0.3 percent after touching a two-year trough on Tuesday.

On Wall Street, the S&P 500 added 0.22 percent, while the Dow rose 0.12 percent and the Nasdaq was up 0.39 percent.

“We remain of the view that a large scale ‘trade war’ remains a low probability though the odds of it happening appear to have increased,” JPMorgan economist David Hensley, told Reuters.

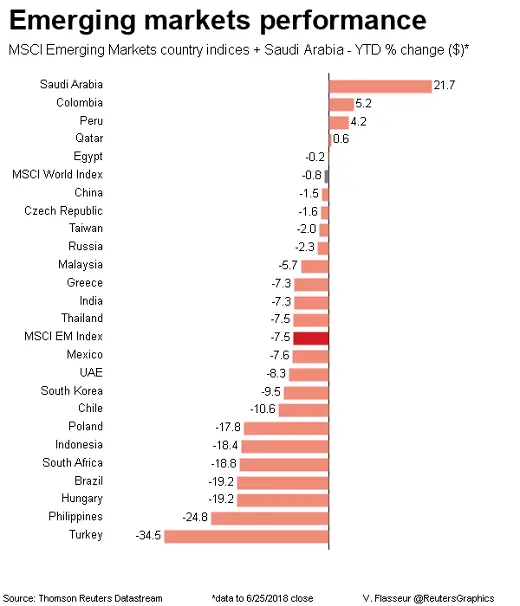

Emerging stocks mostly traded lower on Tuesday tracking a drop in developed markets as trade tensions between the United States and China worried investors across the globe.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Middle East markets

Stock markets in the Middle East were mixed on Tuesday.

Dubai’s index fell 1.1 percent, weighed down by another 10 percent drop in Drake & Scull shares. The stock fell below a key support level of one dirham earlier in the week.

Emaar Properties fell 1.2 percent, while Damac Properties fell 2.2 percent and Union Properties was down 4.3 percent.

The Saudi stock market dropped 0.5 percent as investors shed some blue-chip stocks after a strong rally linked to Riyadh's inclusion in the MSCI emerging market benchmark.

Saudi Basic Industries Corporation was down 0.9 percent, while Samba Financial Group was down 1.5 percent. Both have been among the beneficiaries of this year's surge in Saudi stocks.

Qatar's index slipped 0.5 percent, with Qatar Islamic Bank and Qatar Electricity and Water Co the main weights, falling 2.3 percent and 1.4 percent, respectively.

Egypt’s index fell 1.6 percent, Oman’s index lost 0.3 percent while Bahrain’s index was flat and Kuwait’s index rose 1.1 percent.

Currencies

The dollar was unchanged in early trading on Wednesday against a basket of six major currencies.

The greenback gained 0.4 percent overnight to snap a four-session losing run.

The dollar was 0.1 percent lower at 109.92 yen, after going as high as 110.23 on Tuesday.

Precious metals

Spot gold was last at $1,254.66 having hit its weakest since mid-December at $1,253.50.

In other news…

Kuwaiti state news agency KUNA reported on Tuesday that Kuwait's gross domestic product grew 1.6 percent at constant prices in the first quarter of 2018 from a year ago.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched on June 27, 2018. To keep receiving the newsletter after this date, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018