PHOTO

Emerging operators, regions and users

Takaful Operators

The Takaful business as an Islamic alternative to conventional insurance is emerging rapidly worldwide. From just a handful of players in the 1980s, the number of Takaful operators climbed to 58 in 2003 and swelled to 241 operators in 39 countries worldwide in 2012. This includes full-fledged Takaful operators (TOs), Takaful "windows" within conventional Insurance companies and Re-Takaful Operations. In the last 10 years alone the number of companies has expanded nearly 4-fold. A comprehensive directory of Takaful companies worldwide (as of 2012) reveals that currently there exist:

- 142 primary Takaful companies

- 22 Re-Takaful Businesses,

- 69 Takaful Cooperatives (including 18 in Iran, 35 in Saudi Arabia and 16 Sudan, and 8 closed Takaful businesses.

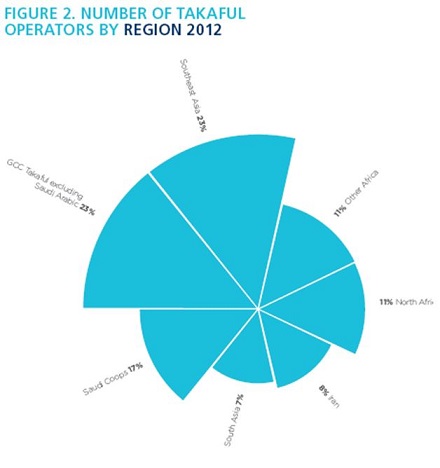

When examined from a regional perspective, there are presently seven major geographical groupings, which shall be used throughout this article:

- South Asian Region - India, Pakistan,

- Bangladesh

- North Africa

- Other Africa

- Islamic Republic of Iran

- Gulf Cooperation Council

- South East Asia

- EU/Caribbean/Turkey and Other

Due to their relative importance and influence on global Takaful, the countries of Malaysia, Iran and Saudi Arabia are sometimes discussed separately. Throughout this article efforts have been made to ensure the data's accuracy, yet due to many Takaful businesses being privately held, their data could not be included in the report. Some inferences and extrapolations of their data were necessitated for comparison purposes.

Since 2003, South Asian countries showed the highest rate of expansion in the formation of new Takaful Operators (from 1 to 15) whereas the GCC remains home to the largest number of Takaful Operators (from 8 to 49). Refer to Fig.1 and 2 below.

The GCC region dominates the Takaful business. Southeast Asia and Africa are the next dominant regions.

At the individual country level, the Islamic Republic of Iran, Malaysia, and Kingdom of Saudi Arabia, host the highest number of Takaful and Re-Takaful Operators: Iran (18), Saudi Arabia (35) and Malaysia (25). Moreover, Takaful companies are cropping up in as diverse markets labeled other (8) as: Luxembourg, UK, Maldives, USA, Trinidad, Tobago and Turkey.

Time in Business:

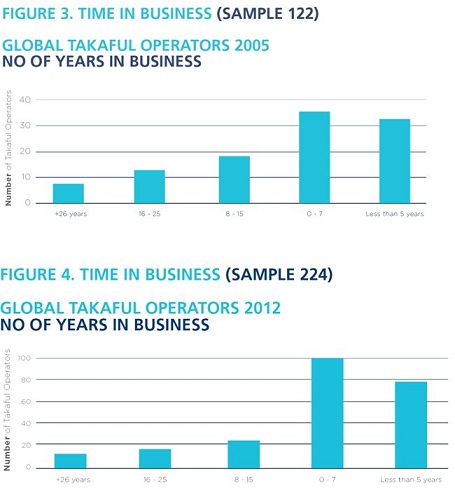

1979 was the year Takaful risk sharing was re invigorated in Sudan, and it can be inferred that this young industry must contain numerous youthful players that are striving to penetrate and sustain in the competitive insurance markets and struggling hard to make a pathway for scaling up operations. The figures 3 and 4 below paint a portrait of the global Takaful industry from data gathered on establishment dates for both Takaful and Re-Takaful businesses.

It is remarkable to note that 75% of Takaful companies in 2005 were in business for less than 15 years and 46% operated for less than 5 years. Sixty-four new Takaful companies were launched between 2003 and 2005 end. Due to the rapid expansion of new Takaful Operators, by 2012, 80% were in business less than 15 years, with 47% having less than 5 years operating experience.

Between 2006 and 2012, there were no less than 101 new Takaful companies formed. The global dominance of GCC Region in Takaful business is gradually eroding as more Takaful operators come on-stream in Africa, Levant, Near East and Asia Pacific regions as well as in the EU/Other region. Among the 101 new Takaful companies, 25 were established in the GCC states, with a threefold being launched in other regions.

© Business Islamica 2016