PHOTO

Investment banking fees in the Middle East & North Africa (MENA) totalled $1.4 billion in 2021, up 3 percent from 2020, according to data available with Refinitiv.

Completed mergers and acquisition fees declined 26 percent to $317.2 million, making up 22 percent of the total investment banking fee pool.

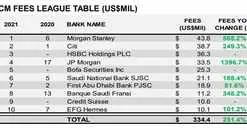

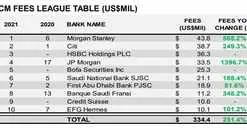

In 2021, equity capital markets recorded their strongest year in 13 years, producing $334.4 million in fees, a 251 percent increase from 2020, Refinitiv said in its 2021 investment banking review report.

Refinitiv, an LSEG (London Stock Exchange Group) business, is one of the world’s largest providers of financial markets data and infrastructure.

According to its data, equity underwriting fees made up 23 percent of the total fee pool, the highest proportion since 2008.

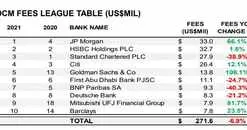

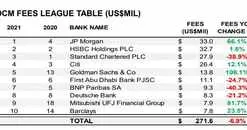

Bond underwriting fees accounted for $271.6 million, down 7 percent, however, still account for one-fifth of the total MENA fee pool.

Fees earned from syndicated lending totalled $525 million, down 12 percent from 2020 and accounted for 36 percent of the total fee pool.

The top fee-paying nations by market share included Saudi Arabia (38 percent), UAE (31 percent), Egypt (11 percent) followed by Qatar (7 percent) and Oman (5 percent).

The financial sector continued its dominance in 2021 for the highest fee-earning sector with $495.5 million in related fees, or 34 percent market share. Government and Agencies were the second highest fee-earning sector with 28 percent market share followed by Energy and Power (25 percent), Industrials (5 percent) and Real estate sector (1 percent).

According to Refinitiv data, JP Morgan rose to the top spot from last year in the region, earning $143.7 million in fees or a 9.9 percent share of the market.

HSBC and Morgan Stanley took second and third place with 8 percent and 6.2 percent market share, respectively, Refinitiv said in its report.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022