PHOTO

Riyadh, Saudi Arabia: Lumi Rental Company (“Lumi” or the “Company”), one of the leading car rental and leasing companies in the Kingdom of Saudi Arabia (the “Kingdom”), today announces the successful conclusion of the institutional book-building process and the determination of the final offer price (the “Final Offer Price”) for its initial public offering (the “IPO” or the “Offering”) on the Main Market of the Saudi Exchange.

The Final Offer Price has been set at SAR 66 per share, implying a total offering size of SAR 1.089 billion and a market capitalization at listing of SAR 3.63 billion. The price range for the Offering was previously set between SAR 62 and SAR 66 per share, which means that the Offering priced at the top of its range. The institutional book-building process generated an order book of approximately SAR 102.9 billion and was 94.5x oversubscribed.

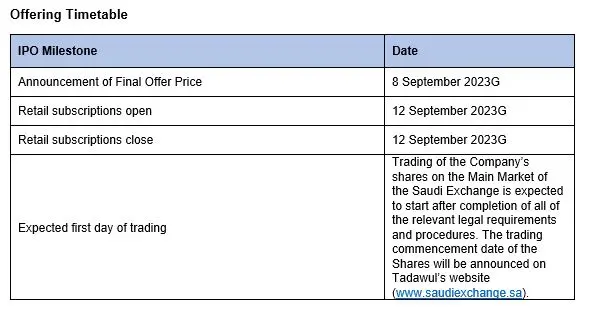

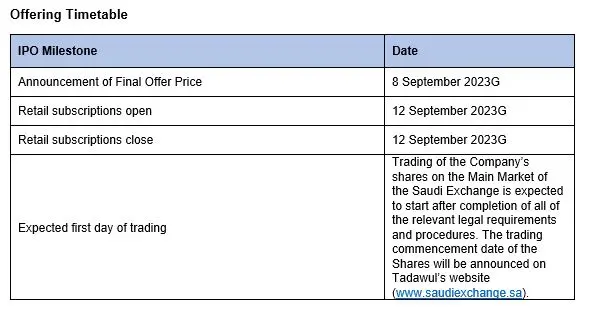

The retail subscription period will take place on Tuesday, 12 September 2023G (one day). Individual investors will subscribe at the Final Offer Price.

Syed Azfar Shakeel, Chief Executive Officer of Lumi, said: “We are delighted to be inviting new shareholders to participate in the Lumi story. The very strong institutional demand for our IPO, which was 94.5x oversubscribed, reflects our position as a key player experiencing rapid growth in a sector that is benefitting from powerful macroeconomic and structural drivers. With our own growth accelerating, this is an exciting time to invite investors to share in our onward journey of success.”

On 29 March 2023G, the CMA approved the Company’s application for an initial public offering of 16,500,000 shares (the “Offer Shares”), representing 30% of Lumi’s issued share capital. The net proceeds of the Offering will be received by the Selling Shareholder, Seera Group Holding (formerly known as Al Tayyar Travel Group).

Company Overview

- Lumi is one of the leading car rental companies in the Kingdom with a unique and diverse offering, including lease services to Corporate and Government sector clients, car rentals via digital channels and a network of 35 airport and city branches across the Kingdom, and used car sales.

- Lumi was established by Seera Group Holding in 2006G as a sole proprietorship to provide car rental services amongst a portfolio of travel companies. In 2016G, as part of the transformation programme to steer Seera Group Holding in a new, more focused direction, strategic plans for Lumi were reconfigured and an expert management team was mobilised.

- The Company’s business consists of three reportable segments:

- Vehicle Lease: long-term lease of commercial and non-commercial vehicles to Corporate and Government sector entities. Lease services include fleet procurement, maintenance, insurance, vehicle replacement, and roadside assistance.

- Car Rental: car rental and related services to retail customers and corporate clients via 35 airport and city branches across the Kingdom as well as through digital channels including website, mobile application, call centre and WhatsApp. Rental services include car rentals, motorcycle rentals, chauffeur services and extra services (flexible drop-off, extra insurance, cross-border permits, optional child seats).

- Used Vehicle Sales: sales of used vehicles from the Company’s own lease and rental fleet through a bidding process or through its car showrooms in Riyadh and Jeddah (Lumi will open an additional showroom in Dammam). Lumi does not sell any third-party used vehicles.

Offering Details

Saudi Fransi Capital has been appointed by the Company as financial advisor (the “Financial Advisor”), lead manager (the “Lead Manager”), and underwriter (the “Underwriter”). Lumi has appointed Saudi Fransi Capital and EFG Hermes as joint bookrunners (the “ Joint Bookrunners”).

The Offering, for which the required CMA and Saudi Exchange approvals have been obtained, will consist of the following:

- The Offering will consist of 16,500,000 existing shares to be sold by Seera Group Holding, representing 30% of the Company’s issued share capital, and will be restricted to the following groups of investors:

- Tranche (A): Participating Parties (institutional investors) - Comprising the parties entitled to participate in the book building process as specified under the Instructions for Book-Building Process and Allocation Method in Initial Public Offerings, issued pursuant to CMA Board Resolution No. 2-94-2016, dated 15 Shawwal 1437H (corresponding to 20 July 2016G), as amended by CMA Board Resolution No. 1-301-2022, dated 2 Rabi’ al-Awwal 1444H (corresponding to 28 September 2022G) (collectively the “Participating Parties” and each a “Participating Party”). The number of Offer Shares to be provisionally allocated to the Participating Parties (collectively, the “Participating Entities” and each a “Participating Entity”) is 16,500,000 Offer Shares, representing 100% of the Offer Shares. The final allocation will be made after the end of the Individual Investors’ subscription (as defined in Tranche (B) below), using the discretionary allocation mechanism by the Financial Advisor in coordination with the Company. As a result, some of the Participating Entities may not be allocated any Offer Shares. The Financial Advisor shall have the right, if there is sufficient demand by Individual Investors and in coordination with the Company, to reduce the number of Offer Shares allocated to Participating Entities to 14,850,000 Offer Shares, representing 90% of the Offer Shares.

- Tranche (B): Individual Investors - Comprising Saudi Arabian natural persons, including any Saudi female divorcee or widow with minor children from a marriage to a non-Saudi person who can subscribe for her own benefit or in the names of her minor children, on the condition that she proves that she is a divorcee or widow and the mother of her minor Saudi Arabian children, as well as any non-Saudi natural persons resident in the Kingdom or GCC natural persons, in each case who have a bank account with a receiving agent and the right to open an investment account with a capital market institution (collectively, the “Individual Investors” and each an “Individual Investor”). A subscription for Offer Shares made by a person in the name of his divorced wife shall be deemed invalid and the applicant shall be subject to the sanctions prescribed by law. If a duplicate subscription is made, the second subscription will be considered void and only the first subscription will be accepted. A maximum of 1,650,000 Offer Shares, representing 10% of the total Offer Shares shall be allocated to individual investors. If the individual investors do not subscribe in full to the Offer Shares allocated to them, the Financial Advisor may in coordination with the Company reduce the number of Offer Shares allocated to Individual Investors in proportion to the number of Offer Shares subscribed by them.

- Lumi shares will be listed on the Main Market of the Saudi Exchange following the completion of the Offering and listing formalities with both the CMA and the Saudi Exchange.

- The net proceeds of the Offering will be received by the Selling Shareholder, Seera Group Holding (formerly known as Al Tayyar Travel Group).

The prospectus for the Offering can be found on the CMA website (www.cma.org.sa) and on the Company’s dedicated IPO website https://lumirental.com/en/ipo.

Contacts

Saudi Fransi Capital

(investor enquiries)

lumi.IPO@fransicapital.com.sa

Joint Bookrunner, Financial Advisor, Lead Manager and Underwriter

Teneo

(media enquiries)

Shady Hamid

Shady.Hamid@teneo.com

Bassem El-Shawy

Bassem.El-Shawy@teneo.com

Communications Advisor