PHOTO

Xpence, a B2B payments platform in the GCC, has entered a strategic partnership with MENA’s leading financial services enabler Paymob at the 24 Fintech conference in Riyadh.

The partnership agreement is set to bolster the digital payment landscape for SMEs across the GCC, according to a press release.

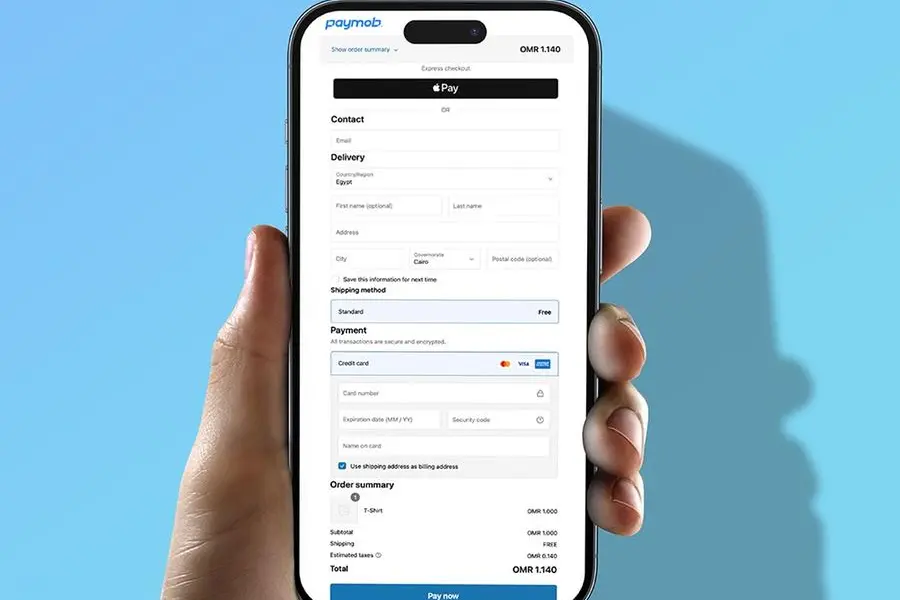

Under the joint deal, Xpence to deploy Paymob’s advanced payment processing technology directly into its platform, allowing SMEs throughout the GCC to seamlessly collect both online and in-person card payments.

Integrating Paymob’s technology into Xpence’s platform will enhance the digital payment infrastructure available to businesses in the region, securing greater efficiency and scalability in their operations.

Hussain Al Herz, Co-Founder & COO at Xpence, stated: "We will be rolling these features out to our customers in the UAE first, providing SMEs with the tools to simplify business payments and improve operational efficiency.”

“This collaboration reinforces our commitment to empowering businesses across the GCC in today’s rapidly evolving digital economy," Al Herz indicated.

Omar El Gammal, EVP of International Business Development at Paymob, noted: "Our collaboration with Xpence is a strategic move that extends our payment solutions to more businesses in the GCC, enabling them to thrive in an increasingly competitive market. Together, we are setting a new standard for digital payments in the region."

Paymob recently raised a $22 million Series B extension round, making its total Series B funding stand at $72 million.