PHOTO

China Investment Corporation (CIC), the second-largest sovereign fund in the world, has issued its action plan for operational carbon neutrality.

The action plan is critical for the sovereign fund to implement carbon peak and carbon neutrality goals following steps over the past two years to attain a sustainable investment policy.

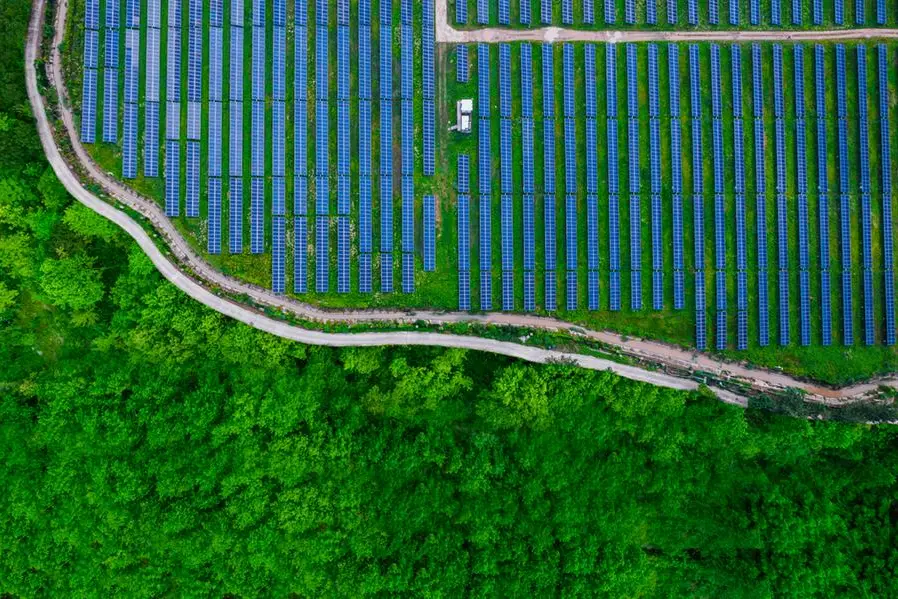

The action plan is developed in line with global peer practices and a review of the carbon emissions in the fund’s operations. It will be supplemented by afforestation for higher carbon sink and achieve operational carbon neutrality by promoting the low-carbon transformation of the economy and society.

Three primary sources of emissions - purchased electricity, data center and products, and employee traveling - are being targeted through 11 concrete steps.

To reduce power consumption, CIC has purchased green electricity and green certificates, optimised office space management, and strengthened employees’ awareness of green and low-carbon habits in the office.

The fund has increased green procurement, reducing unnecessary printing and emphasising waste disposal and recycling to reduce carbon emissions during the entire life cycle of purchased goods and services.

Regarding low-carbon travel, CIC encourages employees to be green travelers and commuters.

Moreover, CIC will focus on new science to reduce the scale and intensity of carbon emissions in its investment portfolio.

In November 2022, Saudi Arabia’s sovereign Public Investment Fund (PIF) targeted achieving net-zero emissions by 2050 through a circular carbon economy approach.

The four largest funds in the Middle East will likely continue in the Top 15 by 2030, when PIF may eventually lead the table with $2 trillion, Global SWF said in its annual report.

(Editing by Seban Scaria seban.scaria@lseg.com)