PHOTO

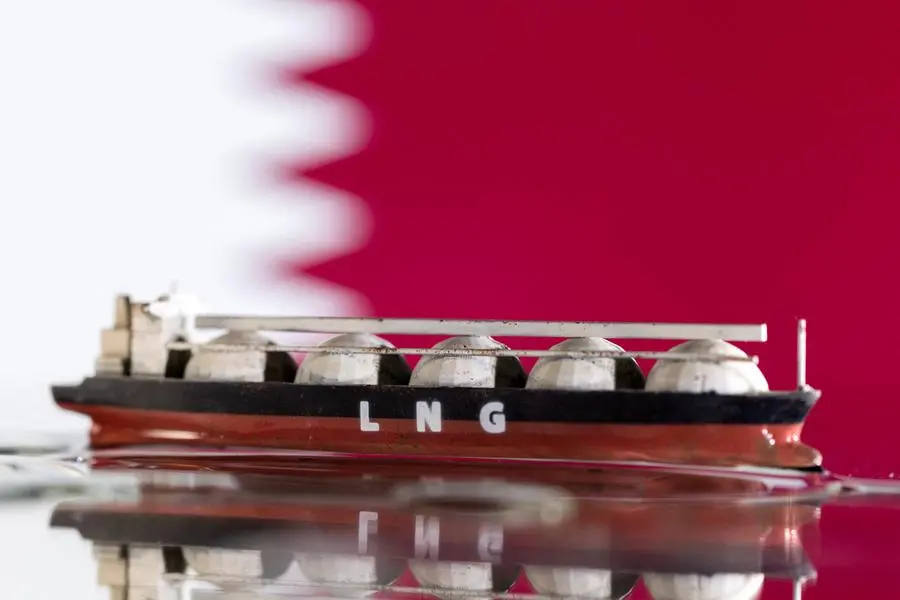

Qatar has driven LNG exports of GECF member countries and observers with y-o-y growth of 6.7% (1.11mn tonnes) to reach 17.66mn tonnes in March, the Gas Exporting Countries Forum (GECF) said in its report released Tuesday.

The growth was primarily driven by Qatar (0.62mn tonnes), Norway (0.44mn tonnes), Mozambique (0.30mn tonnes), Trinidad and Tobago (0.15mn tonnes), Nigeria (0.09mn tonnes), the UAE (0.05mn tonnes), Algeria (0.02mn tonnes) and Peru (0.02mn tonnes).

The increase in Qatar’s LNG exports was due to lower maintenance activity compared to the previous year.

According to GECF, gas and LNG spot prices in Europe and Asia continued to decrease for the third consecutive month.

In March 2023, Title Transfer Facility (TTF) and Northeast Asia (NEA) LNG spot prices averaged $13.87/mmBtu and $13.35/mmBtu, falling by 17% and 16% m-o-m, respectively, and representing a 65% decrease y-o-y.

Despite lower LNG sendout in the region, European spot prices maintained their bearish trend.

Likewise, weak market fundamentals in Asia continued to put pressure on prices.

Moreover, the spread between spot prices and oil-indexed LNG prices in both regions has significantly narrowed in comparison to previous months, GECF said.

In March 2023, European Union pipeline gas imports rose by 14% month-on-month (m-o-m) to reach 13.7bcm. Global LNG imports increased slightly by 2.7% y-o-y to 35mn tonnes driven primarily by stronger imports in Europe and, to a lesser degree, in Latin America and the Caribbean (LAC) and North America.

In contrast, LNG imports decreased in the Asia Pacific and Middle East and North Africa (Mena) regions.

Lower pipeline gas imports in Europe continued to support the increased LNG imports while, Asia Pacific’s y-o-y gain in LNG imports reversed from the previous month.

Mild winter weather and high LNG inventories led to reduced LNG imports in Japan and South Korea, contributing to an overall decline in imports in the Asia Pacific region.

In March, the EU gas consumption recorded a 13% y-o-y decline, reaching 34.1bcm. Factors contributing to the drop in the demand for gas in the EU include warmer than normal temperatures, windier weather conditions, and a year-extension of the implementation of the EU regulation on the voluntary gas demand reduction by 15% until March 2024.

In contrast, apparent Chinese gas demand rose by 4.6% y-o-y to 31bcm. According to the CNPC Research Institute, the country's gas demand would expand by 19bcm, or 5.1% in 2023, totalling 386.5 bcm.

Europe’s gas production decreased by 3.3% y-o-y to stand at 15.3 bcm in February, primarily due to lower output from the Netherlands and UK.

Norway's production remained steady despite technical issues in certain gas fields.

Conversely, gas production from the seven major US shale gas/oil regions rose by 7% y-o-y in March reaching 84.5 bcm.

The global gas rig count declined by 7 units m-o-m but rose by 61 units y-o-y in March 2023, reaching a total of 410 units, GECF noted.

© Gulf Times Newspaper 2022 Provided by SyndiGate Media Inc. (Syndigate.info).