PHOTO

Dubai’s residential market is expected to remain highly attractive to occupants and buyers thanks to the wide variety of options available at competitive prices.

In the short term, however, oversupply will continue to hamper the real estate market. Over 20,000 new residential units were delivered in 2018 and the projections for the remainder of 2019 are significantly higher, according to real estate services firm Chestertons.

Nick Witty, Managing Director, Chestertons MENA, said, “In the short term, oversupply will continue to dampen the value of Dubai’s residential real estate market. This is being compounded by several developer incentives, including five-year post-handover payment plans, registration fee rebates, freezing property service charges and guaranteed rental returns. Similarly, landlords are offering prospective tenants rent-free periods, multiple rent cheques, and even short term leases.”

“The bottom line is Dubai will continue to be tenant and home buyer-friendly for the foreseeable future, until demand has caught up with supply.”

Sales Market

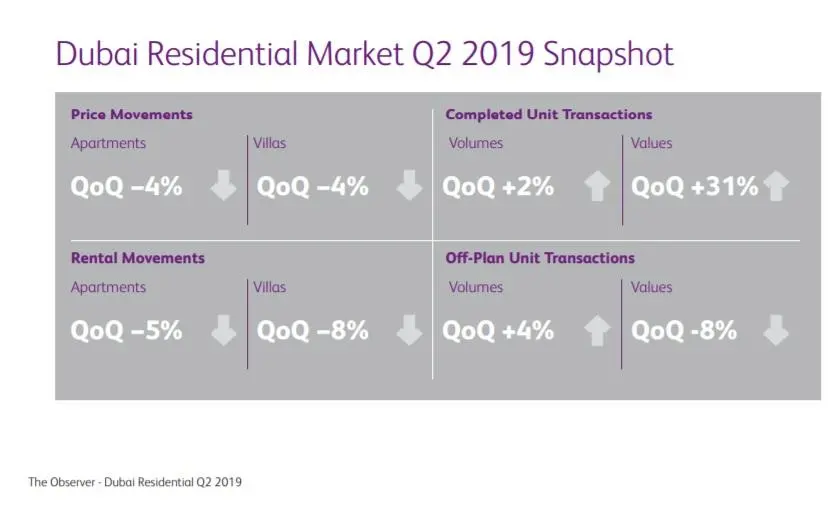

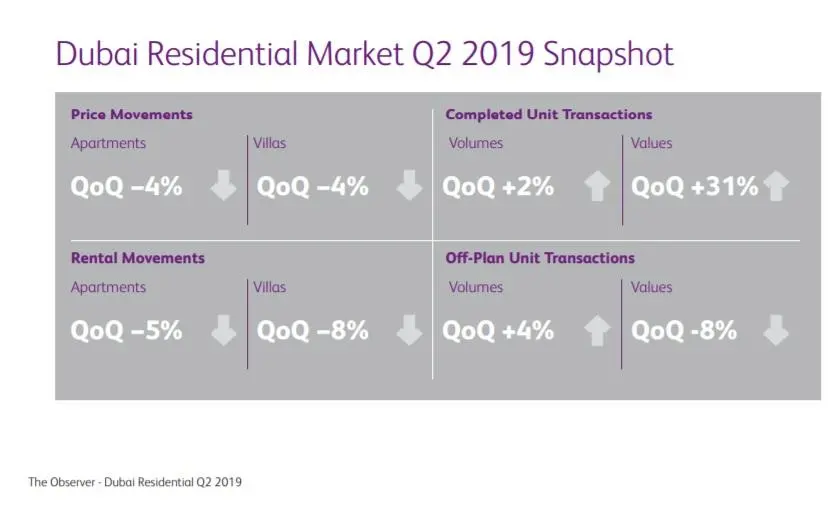

In a research report titled Chestertons’ Observer: Dubai Market Report Q2 2019, the real estate service provider noted that in the sales market, prices for both apartments and villas witnessed a decrease of 4 percent in Q2.

From a villa perspective, Palm Jumeirah remained the most resilient, softening by 1 percent. In contrast, The Lakes witnessed the highest price decline at 6 percent while declines in The Meadows/Springs dropped 5 percent followed by Jumeirah Park softening by 4 percent and 3 percent in Arabian Ranches.

This could be attributed to the fact that many older villa communities are showing signs of fatigue and are in need of refurbishment. This is resulting in a higher level of demand for newer properties, the report said.

In the apartment sales market, The Greens, Dubailand and Dubai Motor City showed relative levels of resilience, only witnessing a 2 percent decrease from the previous quarter. The Views and Downtown Dubai witnessed the highest declines of 9 percent and 7 percent resulting in prices of 1,090 dirhams per sqft and 1,401 dirhams per sqft respectively, which is likely a result of oversupply.

“To remain competitive, we have seen developers becoming increasingly innovative. In partnership with Dubai Multi Commodities Centre (DMCC), Emaar is offering buyers of its Executive Residences in Dubai Hills Estate a free three-year renewable business license, a free three-year renewable family residency visa as well as 100% business ownership for some industry sectors,” said Witty.

Rental Market

In the rental market, there was a more marked weakening compared to Q1, with average apartment rates declining by 5 percent and villas by 8 percent Q-on-Q. As a result, many tenants have seen an increase in potential property options.

Dubai Silicon Oasis saw the largest decline with a typical two-bedroom apartment now 12 percent below the Q1 price at 60,000 dirhams per annum. Dubailand and Discovery Gardens saw average declines of 8 percent with a typical two-bedroom renting for 51,000 dirhams and 75,000 dirhams respectively. The Views, The Greens, Dubai Sports City and JLT recorded an average softening of between 1 percent and 3 percent, with prices of 120,000 dirhams, 100,000 dirhams, 68,000 dirhams and 89,000 dirhams respectively for a two-bedroom apartment.

Established communities including Dubai Marina and Business Bay, which in the past have weathered price reduction to a certain extent, witnessed declines in Q2 of 5 percent, with a two-bedroom apartment in the Marina now available for 110,000 dirhams and in Business Bay for 100,000 dirhams.

“As such, Jumeirah Village Circle, Business Bay, Dubailand and Mohammed Bin Rashid City is where the largest rent reductions are likely to be felt going forward due to the expected supply in these locations,” added Witty.

In the villa rental market, Jumeirah Islands, The Meadows and Arabian Ranches, all witnessed declines of 11 percent, on average, with prices for a typical four-bedroom now 210,000 dirhams, 180,000 dirhams and 160,000 dirhams. Palm Jumeirah was the most resilient location in the villa rental market, denoting a 2 percent decline which was closely followed by The Springs which fell by 3 percent.

The value of transactions completed in Q2 rose by 31 percent from AED5.64 billion in Q1 2019 to 7.37 billion dirhams in Q2, with Downtown Dubai being the most popular location in terms of transaction value at 1.13 billion dirhams.

“Despite price declines across the board, the Emirate’s property market is displaying some positive sentiment as a result of increased transaction volumes in the completed unit and off-plan sectors. The increase in transaction values alludes to the fact end-users are still active and purchasing homes in Dubai,’ concluded Witty.

(Writing by Seban Scaria; editing by Daniel Luiz)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019