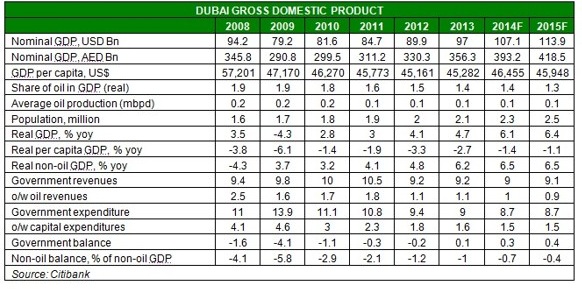

Dubai's gross domestic product is expected to reach USD 107.1 billion, posting a growth rate of 6.1% in 2014 and exceeding Dubai government's estimates of 5%, according to Citibank.

Latest available data from Dubai Statistics Department pegged the emirate's economy at nearly USD 45 billion in the first half of 2013. Dubai's economy has been on a tear over the past 12 month with a slew of data pointing to a new surge in construction activity and a rapid increase in overseas demand for the emirate's travel, logistics and tourism industries.

Corporate earnings in Dubai also rose 36.8% last year, highlighting the fast pace of growth across the economy. The value of projects under way has also picked up, while bank liquidity is much improved.

Public sector leverage in the emirate remains high, at over 100% of GDP according to the IMF, but the successful debt restructurings of the past few years have smoothed out repayment schedules for the debt, which had previously been highly concentrated and short term, said Citibank analyst Farouk Soussa.

"While making the debt burden more manageable, this does not, however, remove all refinancing risk in the emirate, in our view. The pushing out of maturities in many instances is designed to afford time for Dubai's holding companies to see a recovery in their underlying asset values."

"Repayments are to be made using the proceeds of asset sales when this happens. In many cases, these assets are held internationally and/or were purchased at the peak of the global economic cycle in 2006/2007, leaving repayments on Dubai's debt hostage to long-term valuation risk," Soussa said in a May 30 report.

OVERESTIMATING EXPO 2020 IMPACT?

Hosting the World Expo in 2020 will add USD 8.1 billion of new projects to a pipeline that is already brimming with USD 705 billion worth of projects spread over the next 10 years.

The six-month event will likely attract around 25 million visitors and generate revenues of as much as USD 35 billion (or 40% of the city's 2012 GDP) and boost Dubai's GDP by approximately 2% over the coming years.

While Citibank believes hosting Expo 2020 will provide stimulus to the economy during the construction phase starting from 2015 to 2020, and during the event itself, it cautions "against overstating the economic benefits of hosting the Expo."

"In our view, the visitor numbers will not be a net increase in tourism - much non-Expo related tourism is likely to be squeezed out by the event. Effectively, Expo should mean a bumper tourism season of close to 100% occupancy, but Dubai runs at remarkably high occupancy levels during the peak season anyway, so the overall impact should be somewhat less than the visitor numbers imply."

In addition, the impact of building Expo-related infrastructure on the local economy "is likely to be limited and short-lived, as the majority of contractors and workers preparing and managing the event will be foreign," Citi said. "Moreover, we think the government expenditure directed towards the Expo will need to be diverted, at least in part, from other areas of spending to avoid an excessive build-up of debt."

REAL ESTATE'S FINE- FOR NOW

Real estate consultancy Knight Frank's latest report suggests Dubai is the best performing real estate market in the world, rising 27.7% over the past 12 months.

"Dubai, which topped the annual rankings for the fourth consecutive quarter, recorded price growth of 27.7% in the year to the end of March," the London-based consultancy said in a June 1 report. "However, prices rose by 3.4% in the first three months of 2014, evidence that the doubling of transfer fees and the mortgage cap are having an impact on the Emirate's property market."

The pick-up in Dubai's real estate activity has led some to suggest that the UAE is primed for a repeat of the 2003-08 boom-and-bust cycle, but analysts believe such concerns are unfounded - at least for now.

"We think such concerns are premature, not least because leverage levels remain muted, with loan growth running at less than 5% in 2013 compared to more than 50% at the peak of the last cycle. As a result, we see a recovery story that still has some way to run," HSBC said in its report.

Citibank echoed that sentiment, arguing that Dubai is much more resilient to shocks than in mid-2008 for three key reasons.

"First, the banking system is more sound and liquid. Second, Dubai has made considerable progress on deleveraging and smoothing debt maturities. Refinancing risk among some of Dubai's most significant Government Related Entities (GREs) has been significantly reduced. Finally, rising property prices have not, to date, led to a significant rise in construction and leverage."

However, signs may emerge that construction activity is responding to potential speculative demand in the real estate market, and that this is leading to oversupply issues and rising corporate sector leverage.

"In such circumstances, we believe vulnerability to exogenous shocks is likely to creep back into Dubai's economy," Soussa noted.

The feature was produced by alifarabia.com exclusively for zawya.com.

© Zawya 2014