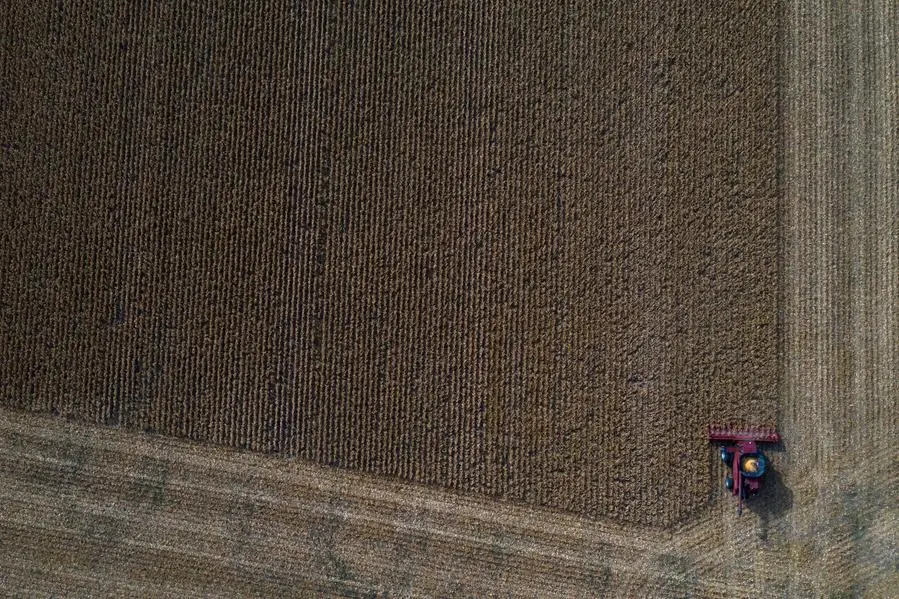

PHOTO

CANBERRA: Chicago corn and soybean futures hovered just below multi-month highs on Wednesday, as U.S. farmers stepped up their selling and took the momentum out of a price rally.

Wheat prices fell slightly without strong upward pressure from rising corn prices.

FUNDAMENTALS

* The most active corn contract on the Chicago Board of Trade (CBOT) was up 0.2% at $4.75-1/2 a bushel at 0126 GMT after reaching $4.80, its highest since December 2023, on Tuesday.

* CBOT soybeans rose 0.1% to $10.48-1/4 a bushel after touching $10.64, their highest since October last year, on Tuesday.

* Wheat dipped 0.1% to $5.46 a bushel.

* Corn and soy futures surged after the U.S. Department of Agriculture on Friday cut its estimates for U.S. 2024 corn and soybean production and end-of-season stockpiles by more than analysts had expected.

* Traders said farmers had begun taking advantage of higher prices to sell. Expectations that rain could aid Argentine crops stressed by a heat wave were also a drag on prices.

* Speculators were again net buyers of corn and soy on Tuesday, albeit at a much smaller scale than on Friday or Monday, traders said. Funds have a hefty net long position in CBOT corn, leaving the market vulnerable to long liquidation, but are net short in soybeans.

* Weighing on soybean prices is the start of Brazil's harvest. State crop agency Conab said on Tuesday Brazil would produce a record-breaking 166.32 million metric tons. Private forecasters predict a harvest as large as 173 million tons.

* Conab also slightly lowered its Brazilian corn production forecast to 119.55 million tons.

* Brazilian soybeans are cheaper than U.S. beans. Exporter group ANEC raised its export forecast for Brazil in January to 2.19 million tons.

* CBOT prices are also under pressure from a strong dollar making U.S. crops costlier for overseas buyers. The greenback has dipped since Monday but remains near two-year highs.

MARKETS NEWS

* U.S. Treasury yields dipped while the S&P 500 ended slightly higher on Tuesday after data showed U.S. producer prices rose less than expected in December, but investors remained cautious ahead of U.S. consumer price data on Wednesday and the start of quarterly earnings reports.

(Reporting by Peter Hobson; Editing by Rashmi Aich)