PHOTO

China's strong domestic demand continued to steer the hotel construction market globally, making Asia Pacific (APAC) the only region in the world to have recorded an increase of five percent in construction activity in the fourth quarter of 2021 over the previous year, according to data provided by hospitality industry data provider STR.

"APAC remains the outlier, and this continues to be driven by China's hotel performance, helped by its robust domestic demand," said Thomas Emanuel, Director at STR.

Whereas other key hotel markets, including Europe (-7.6 percent), Middle East & Africa (-5.5 percent), and the Americas (-16.8 percent), recorded a fall in hotel construction activities in December 2021 as a fall out of the COVID pandemic that hit the hospitality sector hard.

He pointed out that hotel development has been very robust over recent years, but "a combination of factors, all relating to the pandemic, are impacting construction, including labour and supply chains."

Additionally, Emanuel said the drop in demand felt due to the pandemic means that the need for new properties is not as strong.

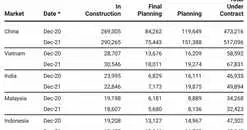

But the Asia Pacific region emerged as a bright star in this gloomy period, as China and Vietnam led the hotel construction activity in the region, with 290,265 and 30,546 rooms under construction, respectively, as of December 2021.

APAC shines bright

Global commercial real estate and investment firm CBRE attributed the steady hotel construction activity in the Asia Pacific to "strengthening investor sentiment" towards hotels through the course of 2021, thanks to progressing vaccine rollouts and staged re-openings to fully vaccinated tourists.

"The first three quarters of 2021 saw hotel transaction volume in the Asia Pacific reach $6.5 billion, which was 5 percent higher than the corresponding period in 2020," said Steve Caroll, Head of Hotels & Hospitality, Asia Pacific, Capital Markets at CBRE.

He said resort destinations were the primary beneficiaries of border re-openings and pent-up travel demand as consumers sought out locations offering seclusion and an outdoor travel environment.

Within the APAC region, though, STR data revealed that other key markets, including India (22,846), Malaysia (18,607), Indonesia (18,435), recorded a fall in hotel construction activities in the fourth quarter of 2021 compared with the previous year.

"The Asia-Pacific numbers are really about China. More than 60 percent of rooms under construction in the Asia Pacific are in China itself. China is near an all-time high in the number of projects under planning or construction," said Daniel Ho, Co-Founder, and Group Managing Director, Juwai IQI.

He said the hotel construction pipeline in China is booming because of pent-up projects that were put on hold early in the pandemic and have since been resumed.

"In the first half of 2021, only about 37,000 new rooms opened in China. In the second quarter, the number of openings hit a record low because so many projects were on hold," Ho said, citing data from Lodging Econometrics.

Sharing the feedback that he is getting from developers, Ho said even with the Omicron variant, "developers are more comfortable restarting projects today and expect good economic returns."

Strong domestic demand

STR said China's strong domestic demand base is a crucial reason hotel brands are keen to continue to grow their footprint across the country. "When COVID restrictions were not in place across China, performance recovered very quickly due to domestic demand," Emanuel explained.

Juwai IQI Co-Founder feels China wasn't as hard-hit by the pandemic as many think. "Yes, international tourism has been down, but with certain regional exceptions, for most of 2021, domestic travel recovered strongly."

He cited the Ministry of Culture and Tourism data, which reported that the Chinese made more than 88 million domestic trips during the three-day 2021 Mid-Autumn Festival holiday. "That's about 87.2 percent of the record number of trips made in 2019."

CBRE pointed out that markets with a robust domestic tourism base experienced a greater uplift, evidenced by China which saw resort destinations like Sanya experience higher hotel occupancy than urban locations like Beijing, and Tasmania, which posted a faster recovery than the Australian national average.

Outlook

Looking ahead, CBRE said positive growth in the Asia Pacific is likely to be driven by mainland China, Australia, and Japan "as these markets have about 80 percent of hotel demand originating from domestic tourism, resort markets, in particular, are expected to be a focus for experienced investors."

"We expect investors taking a longer-term view towards investment returns to become more active in the coming months to seize new opportunities in the hotel sector, as there continues to be a large quantum of capital looking for returns," said Caroll.

STR said construction is likely to increase once the beginning of the end of the pandemic is firmly in sight. "Markets such as China, the UAE, and Saudi Arabia will be amongst those leading the way. We also anticipate an increase in resort development as leisure demand is, in many cases leading the recovery," concluded Emanuel.

(Reporting by SA Kader; Editing by Anoop Menon)

(anoop.menon@lseg.com)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022