PHOTO

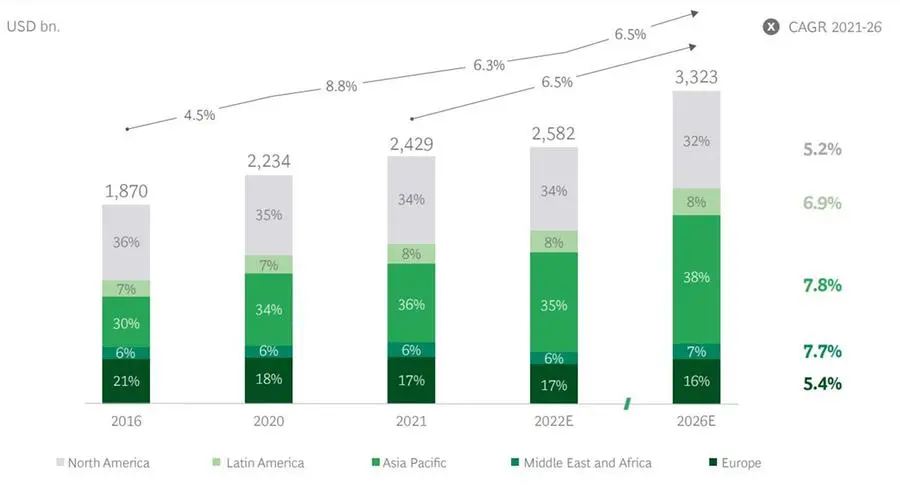

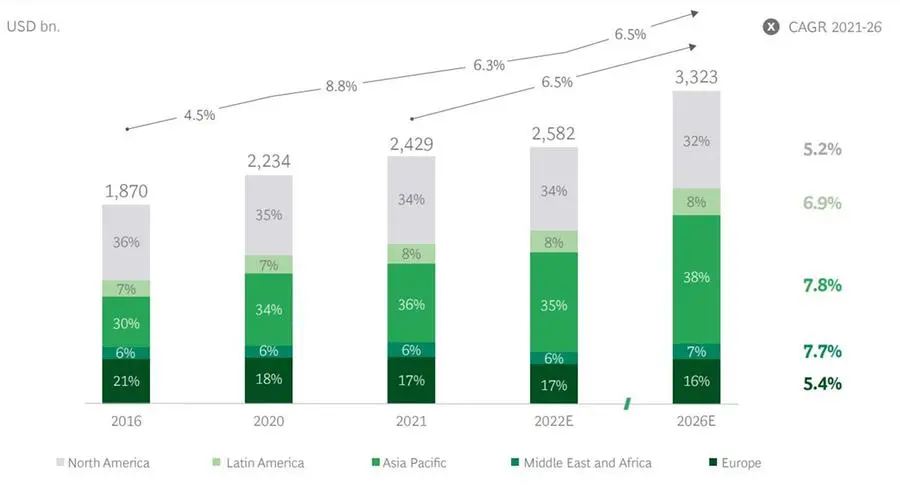

Banks in the UAE and the rest of the Middle East and Africa are expected to outperform many of their peers globally, with retail revenues in the region forecast to grow 7.7% every year between 2021 and 2026, according to a new report.

The growth will be the second highest in the world after Asia Pacific, where banks will see revenues rising by 7.8% every year, and outstrip those in other markets, including Europe, the latest data from Boston Consulting Group (BCG) showed. The growth will be driven by increased spending on ESG and sustainability, as well as higher consumer expenditures and oil prices.

The US-based firm estimated that retail banking revenues in the UAE will grow by 6.4% every year during the same period. Banks in Europe and North America will grow more slowly, with retail revenues forecast to grow at a compound annual rate of 5.4% and 5.2%, respectively.

“Through the five years from 2021 to 2026, payments, mortgages and deposit products are [also] likely to drive banking revenue growth in the GCC retail banking sector,” the report said.

“An accelerated pace of digital payments and e-commerce adoption in the wake of COVID-19 will further benefit payment revenue growth.”

Global Retail Banking Revenues

Key global drivers

In its report, BCG noted that bank deposits will be the leading driver of revenue growth globally, as central banks increase interest rates in a bid to tame inflation.

Payments will grow by 6.3% every year, as more people choose online, credit card and other non-cash transactions and payment products innovate.

Revenues from consumer and retail borrowings are expected to rebound to growth rates of around 4%, as consumers’ spending appetite rises on the back of receding effects of the COVID-19 pandemic.

BCG also highlighted that retail banks polled for its study said that ESG is a primary focus area for their digital transformation efforts.

More than a third (38%) of the banks said that ESG is a key criterion in selecting and prioritizing digital transformation initiatives.

(Reporting by Cleofe Maceda; editing by Daniel Luiz)