PHOTO

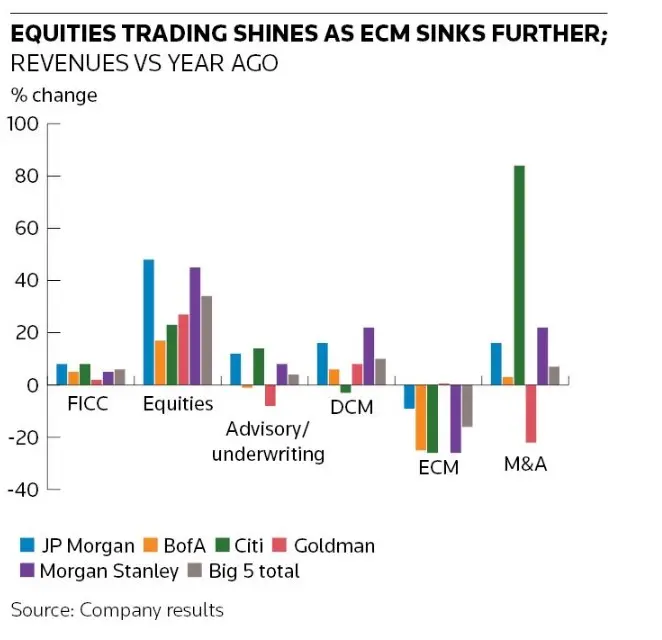

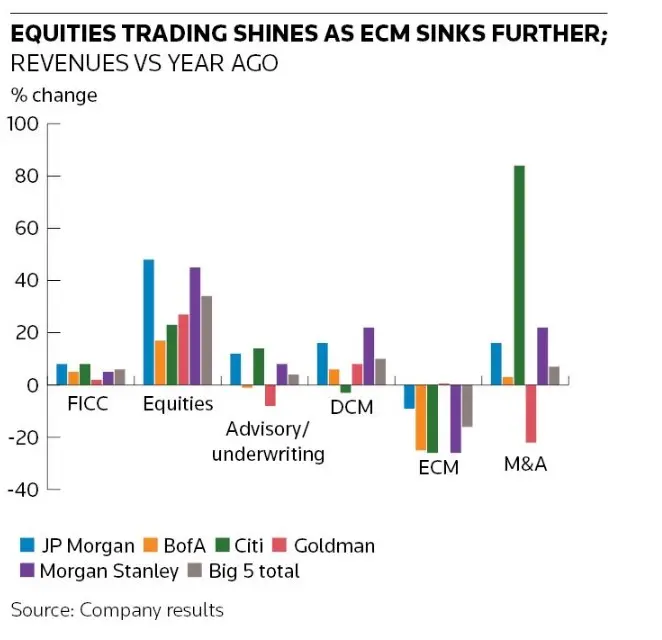

The volatility in global markets that supercharged trading in the first quarter has stalled any rebound in investment banking – especially M&A advisory.

“In investment banking, the volatile backdrop led to more muted activity relative to the levels we had expected coming into the year,” said Goldman Sachs chief executive David Solomon.

Across the five largest US banks – Goldman, JP Morgan, Morgan Stanley, Bank of America and Citigroup – revenues from investment banking totalled US$8.4bn, up 4% from a year earlier and hardly the level banks were expecting heading into the year. But talk of tariffs killed the animal spirits. Ever the optimists, however, bank CEOs say the animal spirts are not dead, just sleeping.

“As we stand today, our client dialogues remain elevated, and our backlog is up for the fourth consecutive quarter,” Solomon said. “That being said, our ability to execute on these transactions will of course be dependent on market conditions.”

US president Donald Trump levied tariffs on trading partners Canada and Mexico in the first quarter and threatened to levy tariffs on most US trading partners on April 2. The threat forestalled any rebound in dealmaking for at least another quarter, although Trump relented on his trade policy after a bond market rout, and cut planned tariff levels on most countries other than China. But uncertainty and volatility remain.

“The uncertainty around the path forward and fears over the potentially escalating effects of a trade war have created material risks to the US and global economy,” Solomon said. “We are encouraged by the administration's recent actions to pursue a more gradual policy process that allows for considered negotiations with many countries, but how policies will evolve is still unknown.”

"Pausing plans"

Investment banking revenues at Goldman in the January–March quarter were US$1.9bn, down 8% from a year earlier. It was the only top five US bank to see a decline in the quarter, largely due to a drop in advisory fees.

JP Morgan's investment banking revenues rose 12% to US$2.2bn, easily holding the top spot among investment banks in the quarter.

Revenues from advisory across the five banks in Q1 was US$2.9bn in aggregate, up 7% from a year earlier. Only Goldman saw advisory revenues fall, with a 22% drop to US$792m. Citi showed the biggest rebound in the quarter with revenues up 84% to US$424m.

“You're seeing deals still happening,” said Citi CEO Jane Fraser. “We've done a number of them… we were pretty busy. But I would say that most clients are pausing their plans.”

Revenues from debt underwriting in Q1 rose 10% in aggregate to US$4.2bn. JP Morgan led the pack with DCM revenues rising 16% to US$1.2bn. DCM revenues rose 22% to US$677m at Morgan Stanley. Citi was the only bank among the top five to see DCM revenues slip in the quarter, by 3% to US$553m.

ECM activity continued to struggle in the quarter as the victim of highly volatile equity markets. Morgan Stanley said activity was muted as issuers and investors evaluated the evolving landscape, particularly in the Americas.

Revenues from equity underwriting across the five banks were down 16% in aggregate to US$1.4bn. Goldman's ECM revenues were flat compared with a year earlier, but all its rivals reported a drop in the quarter.

Despite the slowdown in investment banking activity relative to expectations, all five banks said their pipelines have remained strong.

“Fundamentally, the banking pipeline hasn't changed,” said Morgan Stanley CEO Ted Pick.

He said some clients have just hit the pause button. “They're not deleting; they're pausing,” Pick said. That could result in some of the IPO stack or some of the M&A activity moving out a quarter or two. "But this is not a question of people rethinking their priorities around technology, energy, competitive dynamics within their industries,” he said.

Source: IFR