PHOTO

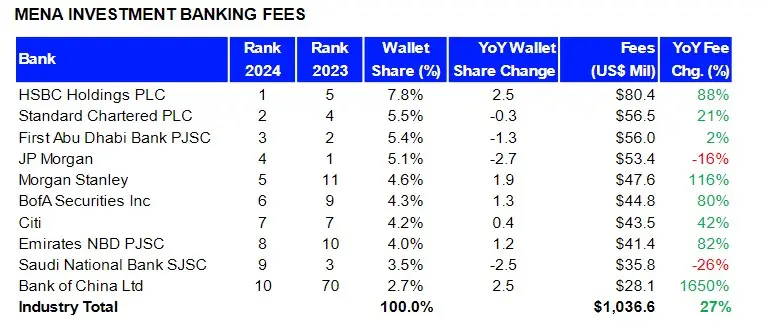

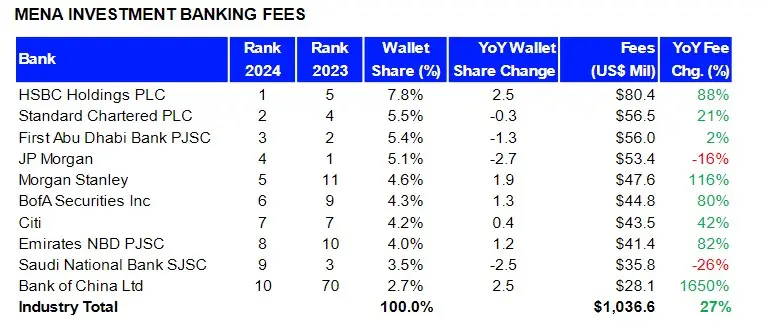

An estimated $1 billion in investment banking fees were generated in the Middle East and North Africa during the first nine months of 2024, 27% more than the value recorded a year ago.

HSBC earned the most investment banking fees in the region during the first nine months of 2024, a total of $80.4 million, or a 7.8% share of the total fee pool, according to LSEG Deals Intelligence.

HSBC was followed by Standard Chartered ($56.5 million) and First Abu Dhabi Bank ($56 million) in the league tables.

LSEG Investment Banking fees are imputed for all deals without publicly disclosed fee information.

The highest investment banking fees, at $470.7 million, were generated from Saudi Arabia, followed by the UAE ($395.9 million), Qatar ($45 million), Kuwait ($41.7 million) and Egypt ($25.1million).

Investment banks generated $339.9 million from governments and agencies in the MENA followed by the financials sector ($280.2 million) and the energy and power sector ($245.6 million)

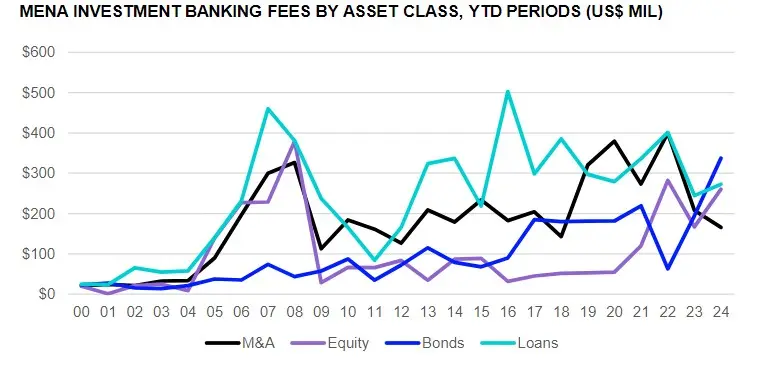

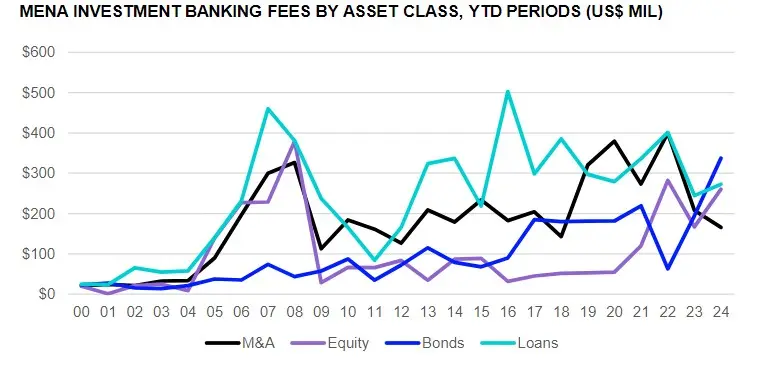

While the equity capital markets underwriting fees increased 56% year-on-year to $260.5 million, debt capital markets underwriting fees increased 74% to $337.6 million.

EFG Hermes took first place in the MENA ECM underwriting league table during the first nine months of 2024, with a 9% market share.

Standard Chartered took the top spot in the MENA bond bookrunner ranking during this period with US$10.2 billion of related proceeds, or a 10% market share.

Advisory fees earned from completed M&A transactions totalled $165.5 million, a 20% decline from year-ago levels, and the lowest first-nine-month total in the region since 2018.

The value of announced M&A transactions with any Middle East or North African involvement reached $55.9 billion during the first nine months of 2024, down 4% compared to year-ago levels and the lowest first nine-month total since 2018. The number of deals announced in the region increased 1% from last year at this time.

The largest deal with MENA involvement during the first nine months of 2024 was ADNOC’s $14.8-billion takeover offer for German chemicals company Covestro. The largest announcement during the third quarter was UAE clean energy firm Masdar’s offer to buy Spanish green energy firm Saeta Yield from Brookfield Renewable for $1.4 billion.

Morgan Stanley took first place in the M&A financial advisor league table with any MENA involvement during the period for their advisory work on deals worth a combined $25.6 billion.

Syndicated lending fees in investment banking increased 12% to a two-year high of $273 million.

Forty-five percent of all MENA fees were generated in Saudi Arabia during the period, followed by the UAE (38%).

(Reporting by Seban Scaria; editing by Daniel Luiz)