PHOTO

HSBC Holdings is forging ahead with a brand-new plan that will downsize its investment banking business in the West and will focus instead on Asia and the Middle East.

The banking giant has already been a leader in the MENA region for ECM and DCM in the past four consecutive years and is hoping to make a splash in Asia by building on its MENA success.

“We will retain more focused M&A and equity capital markets capabilities in Asia and the Middle East and will begin to wind down our M&A and equity capital markets activities in the UK, Europe, and the US, subject to local legal requirements,” the bank said in a statement.

The latest move is part of the ongoing efforts to simplify the bank and increase leadership in its areas of strength.

“HSBC has a commanding position in MENA equity capital markets, whereas it has struggled to achieve equivalent status in the US in particular. The bank's ranking in M&A advisory work has been declining over the long term. It's a fiercely competitive market, and with deal volumes in Europe having been depressed in recent years, maybe it is no longer worth prioritising this region,” Alex Marshall, Senior Partner at consultancy firm CIL, said.

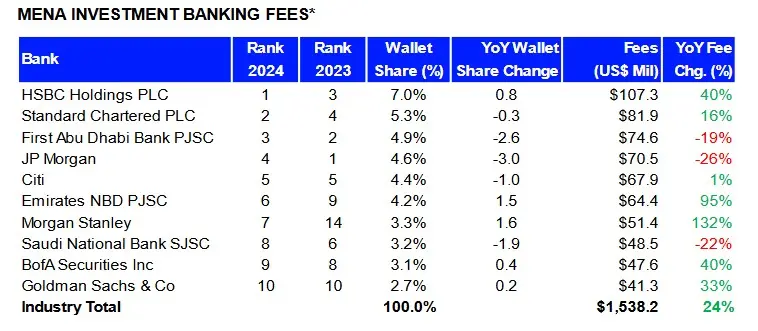

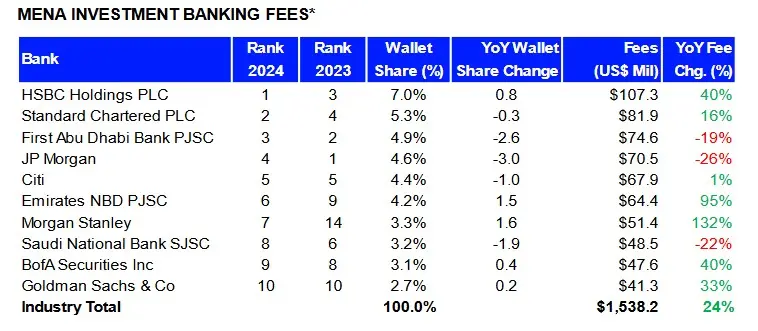

According to LSEG data, HSBC earned the most investment banking fees in MENA during 2024, a total of $107.3 million, or a 7% share of the total fee pool.

“We have substantial issuances on local currency, especially in the Saudi market. If you include issuances in local currency, HSBC MENA tops league tables acting on over $15 billion of credited bond and sukuk offerings in 2024,” Khaled Darwish, Managing Director - Head of CEEMEA Debt Capital Markets at HSBC, told Zawya in a recent interview.

RELATED STORY: Interview: Deals worth $137.5bln signal upbeat MENA debt capital market: HSBC

The bank was ranked second only after EFG Hermes, according to LSEG data, in MENA ECM deals, with proceeds worth $2.3 billion.

LSEG Investment banking fees are imputed for all deals without publicly disclosed fee information.

Lebanon-born Georges Elhedery is the global CEO of HSBC. He has been spearheading a restructuring programme after replacing Noel Quinn as chief executive last year. The restructuring has seen many senior managers losing jobs, while the MENAT region saw a new order of leaders.

RELATED STORY: HSBC shakes up senior leadership team, appoints new Middle East CEO

“I think HSBC's move reflects a realistic and pragmatic doubling-down of their bet on Asia and MENA capital flows. They aren't really abandoning a position of great strength in Europe and the US by contrast to their dominance in other markets,” Marshall said.

(Reporting by Seban Scaria; editing by Daniel Luiz)