PHOTO

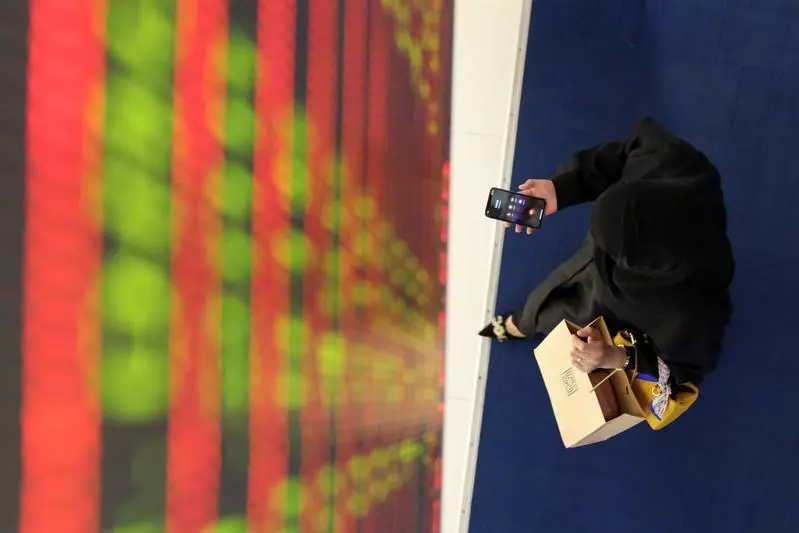

The fallout from US President Donald Trump’s April 2 global tariff announcement may take a few months to stabilise, warned GCC analysts, following a sharp selloff on Monday that wiped out trillions of dollars in value from world markets.

While experts maintained GCC economies were largely shielded, a possible blowback could be visible on the quarterly earnings cycle and the region’s IPO pipeline.

Standard Chartered’s Executive Director and MENA Economist Carla Slim chose a more cautious approach. “We see little direct impact from the actual tariffs to GCC’s exports to the US, given GCC exports to the US are low. Still, steel and aluminum tariffs may have a negative impact on the UAE’s and Bahrain’s metal exports,” she told Zawya.

According to the economist, there would be more “significant impact” to the GCC through indirect channels.

Slim indicated an oil price forecast to the downside, while adding: “Brent has already priced in global growth downside as well as OPEC+ tripling planned oil production increase.”

US West Texas intermediate crude took a dive on Friday, falling below $60 a barrel to its lowest since 2021 on tariff-fuelled recession fears.

Experts have said Trump’s tariffs will have significant implications on the global oil trade and, consequently, the MENA’s oil-dependent economies, with a dampened market demand and rising consumption costs.

“As a result, oil prices would decline, dealing a blow to the region’s oil producers,” wrote American think tank Atlantic Council’s Inwook Kim. “If history is any guide, a prolonged oil price slump could destabilise the oil economies, with mounting fiscal pressure, potentially leading to reduced public spending.”

Experts are closely tracking fluctuations in oil prices, with Pepperstone’s Research Strategist Ahmad Assiri calling the drop in oil prices to four-year lows “particularly detrimental” and “straining the fiscal budgets of GCC nations.”

“This decline is critical as these countries rely still heavily on oil revenue to finance large-scale projects and accelerate economic reforms and diversification efforts. Hence, these measures are rattling investor confidence,” Assiri told Zawya.

Mid-term risk

With threats of an all-out trade war looming on the horizon in wake of retaliatory tariffs on US imports announced by China and likely from the EU, experts are warning that investor confidence could take months to return, despite the Trump administration’s implementation of a 10% tariff baseline for GCC countries.

“The uncertainty surrounding the tariffs and their potential impact on global trade could lead to continued market volatility over the next 2-3 months,” said Hamza Dweik, Head of Trading and Pricing, Saxo Bank MENA. “The recent increase in inflation in the GCC, driven by factors such as food and transport price, adds to the complexity. Fluctuations in the dollar’s value due to trade tensions could impact the cost of imported goods, potentially leading to higher consumer prices and inflation.”

According to Dweik, for the UAE, Saudi Arabia, and Qatar, these tariffs could lead to increased export costs, potentially hindering their competitiveness in the American market.

Standard Chartered’s Slim also said GCC investments to the US could be indirectly impacted in the aftermath of the Trump tariffs, with the “UAE and Saudi to each commit to $1 trillion of investments over the coming years.”

The expert also warned of financial markets outflows affecting the wider MENA region. “Economies that have benefited from carry trades, such as Egypt, are prone to external sector vulnerabilities and currency pressure if outflows materialise due to the global market sell-off,” Slim said.

Subdued outlook

Analysts are also warning the US tariffs will weaken revenue and profitability growth for many corporate sectors across the region.

“The potential tightening of fiscal policy and business activities contributes to a less positive economic outlook, leading to a correction in what had previously been elevated market valuations,” said Assiri. “Such a correction aligns the market more closely with the underlying economic realities, reflecting a recalibrated perspective on the future growth potential and profitability of businesses within the region.

“The uncertainty and economic adjustments stemming from trade tension and potential fiscal shifts are likely to result in subdued growth in Q2 earnings for many companies, particularly those with a large exposure to Asian markets, if the trade tensions persist.”

While experts agree that US tariffs are likely to push up prices, which will squeeze profit margins in the current quarter for GCC countries, the outlook is hopeful for countries that have diversified their economies beyond oil.

Arun Leslie John, Chief Market Analyst at Century Financial pointed out that both Saudi and the UAE are expected to lead growth in non-oil sectors in the coming months at 5.8% and 4.8%, respectively, driven by government spending on mega-development projects like NEOM in Saudi Arabia and Vision 2031 in the UAE.

“This growth trend can act as a shield for Q2 profits, particularly in sectors like tourism, entertainment, and renewable energy, which stand to benefit from these mega-development projects,” he said.

The fallout of the Trump tariffs could also have an impact on the GCC IPO pipeline, warned experts, which includes names such as Etihad Airways and Abu Dhabi’s IHC-backed 2PointZero.

Saxo Bank’s Dweik said that while the GCC remains optimistic, “the current market turmoil and uncertainty could lead to delayed listings in the short- to mid-term. Companies may reconsider their IPO plans given the increased volatility and potential impact on investor confidence.”

(Reporting by Bindu Rai, editing by Brinda Darasha)