PHOTO

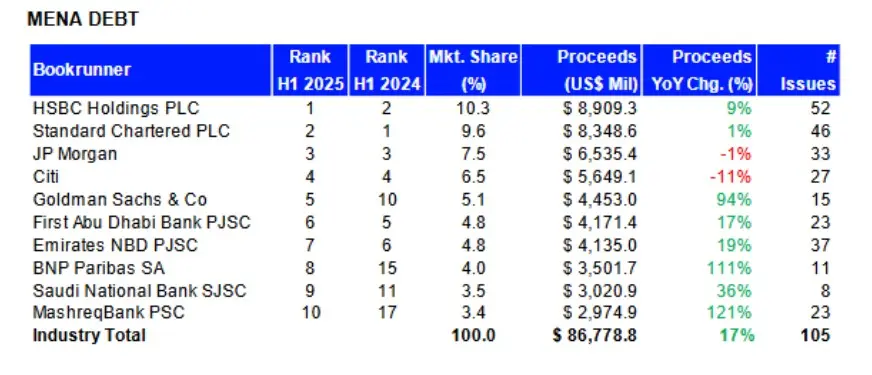

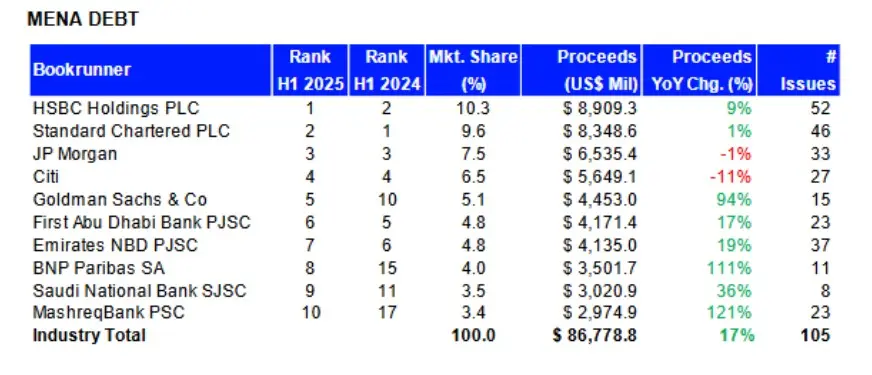

MENA bond issuance totalled $86.8 billion during the first half of 2025, 17% more than the value recorded last year at this time.

According to data from LSEG, HSBC Holdings ranked as the top bookrunner in the region, leading 52 issues with proceeds totalling $8.9 billion and capturing a 10% market share.

Saudi Arabia was the most active issuer nation during the first half of 2025 accounting for 52% of total bond proceeds, followed by the UAE (25%), and Qatar (8%). While corporates accounted for 55% of the total proceeds raised during the first half of 2025, government and agency issuers contributed 26%.

“There is great diversification in the breadth of issuers, whether sovereigns, corporates, or banks, when it comes to debt issuances, and that’s one of the standout stories of H1,” said Khaled Darwish, Head of CEEMEA Debt Capital Markets at HSBC.

The range of markets that have been accessed by issuers has also been impressive, Darwish said, citing instances of issuers increasingly going for sukuk and Formosa, active Tier 1 markets, issuers accessing local currency markets in Saudi and the most recent digital bond HSBC has done with FAB and ADX.

Besides the sovereigns, notable debt issuers included Saudi Arabia’s Ma’aden and the Saudi Real Estate Refinance Company (SRC), both of which launched debut USD sukuk offerings. Saudi Electricity also tapped the market with a dual-tranche sukuk. In the UAE, leading conglomerates such as Mubadala, ADQ, and Masdar were active participants. Additionally, Tier 1 capital issuances saw strong momentum across the region.

“Egypt returned to the debt markets with a bond issuance and Qatar tapped the bond markets in February with a $3 billion bond issuance,” Darwish said.

LSEG Investment Banking fees are imputed for all deals without publicly disclosed fee information.

“The Tier 1 market has been very active as well. We have also seen an opportunistic funding approach by regional banks - FAB issued a $600 million sukuk, two successful Formosa visits and the recent digital bond in the first half. ENBD visited the Australian dollar debt market and issued a Formosa bond. ADCB also successfully accessed the Formosa market twice,” he added.

Islamic bonds in the region raised $32.2 billion during the first half of 2025, 14% more than last year’s total to reach an all-time first-half record. Sukuk account for 37% of total bond proceeds raised in the region, compared to 38% last year at this time. According to LSEG, Standard Chartered, HSBC and EmiratesNBD were the top book builders.

Besides a bevy of Saudi sukuk issuances, the UAE’s ADNOC made its debut in H1 2025 with a $1.5 billion sukuk. Structured via ADNOC Murban Sukuk Limited, the issuance represented the largest AA-rated corporate sukuk ever issued globally.

“One notable aspect of the sukuk market is that the much-debated regulatory changes, particularly the implementation of AAOIFI Standard 62, did not materialize in H1. The sukuk market remains in a steady state,” Darwish said.

HSBC has been ranked as the top DCM bookrunner in both Asia and the MENA region for the first half of the year, five years in a row. Thanks to its legacy European debt market and its new strategic shift towards Asia and the Middle East. The bank has also effectively leveraged its dominance in the Asian market, which has played a key role as MENA issuers are increasingly pivoting toward Asia for debt capital market demand.

“The success of GCC Tier 1 market has been built in part on private market capital from Asia, which is another key focus area for HSBC. Similarly, HSBC’s leadership in Asia’s major markets aligns well with China’s growing interest in participating in the GCC’s fixed income markets,” he said.

The fixed income market in the region has been evolving continuously. Oil revenues have empowered top GCC nations with unprecedented investment capacity, boosting surpluses, strengthening sovereign wealth funds, and improving credit ratings, including for countries like Oman and Qatar.

Undoubtedly, countries such as Saudi Arabia, Egypt, and Turkey will feature among the top three markets for a U.S. fund manager. But it’s not just the yield story that investors are after.

“It’s important to note that GCC countries have strong credit fundamentals, and this year has demonstrated that despite geopolitical developments, the region offers remarkable resilience,” Darwish said.

(Writing by Seban Scaria; editing by Daniel Luiz)