PHOTO

Wednesday, Oct 07, 2015

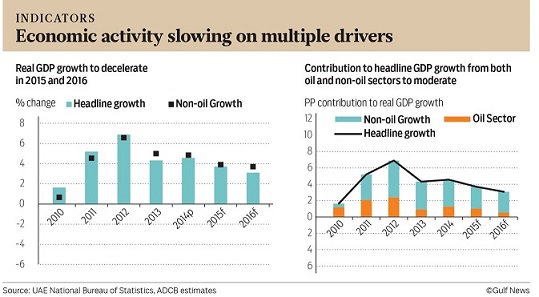

Dubai: The UAEs economy is showing signs of slowing on the back of the sharply weaker oil price, which is filtering into the non-oil economy according to an economic research report from Abu Dhabi Commercial Bank (ADCB)

Factors such as softening real estate prices in Dubai, gradual fiscal tightening, and the strong dollar are also contributing to the slowdown in economic activity.

We expect real GDP growth to decelerate in 2015 and 2016, though to remain comfortably positive. Interim indicators point to economic activity moderating in 2015, with the sharply weaker oil price filtering into the non-oil economy, said Monica Malik, chief economist of ADCB.

The lower oil price environment is impacting investment spending and consumer confidence. Nevertheless, the continuation of core investment projects and the healthy performances of key service sectors (such as tourism) support the economic outlook.

The UAE is among the best positioned of the GCC countries to withstand the lower oil price environment thanks to its comparatively diverse economy and strong FX reserves. We see headline real GDP growth moderating to 3.7 per cent in 2015 (from 4.6 per cent in 2014) and real non-oil GDP growth accelerating to 3.9 per cent (from 4.8 per cent). We believe that stronger investment linked to the Dubai Expo 2020 should help to boost growth from 2017, said Malik.

The UAE has been one of the most proactive GCC countries in terms of implementing fiscal reforms in 2015, despite its economy being among the most resilient. A tighter fiscal stance is being taken on both the expenditure and subsidy reform fronts.

The recent fiscal reforms are seen as highly positive for fiscal sustainability, and consequently resulting in a narrower (than previously forecast) and relatively contained fiscal deficit of -3.6 per cent of GDP in 2015.

We also view the gradual approach being taken to fiscal reform as positive for sustainable future growth, believing that it reduces the likelihood of a sharp spending retrenchment in future. We expect further fiscal reforms going forward, as oil prices look likely to remain depressed during our two-year outlook period. The government has indicated that it is considering revenue reforms, including introducing VAT and corporate taxation, Malik said.

Monetary conditions are also tightening as banking sector liquidity moderates. Interbank rates have started to increase from their previously low levels, due largely to the government tapping banking sector deposits to help cover spending as oil revenues decline. While credit growth remains solid largely driven by retail, lending interbank rates is expected to continue rising in the fourth quarter of 2015 and 2016 in response to the ongoing withdrawal of government deposits prompted by the weak oil price. However, the expected moderation in lending growth could partly offset the tightening at the end of 2015 and in 2016.

Despite economic challenges having increased, the economy is expected to be resilient, supported by numerous recent reforms, including those relating to personal leverage and the real estate sector. As such, the softening in economic activity seems to be relatively contained compared to the sharp contraction seen at the end of 2008 and in 2009. The economys strong fundamentals are also underpinned by the FX reserve position, as well as the economic base, which is more diverse than those of other GCC countries.

By Babu Das Augustine Banking Editor

Gulf News 2015. All rights reserved.