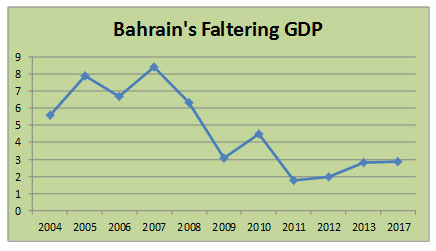

While Middle East oil exporters could see a 4.8% GDP growth this year, Bahrain would be lucky to eke out a 2% increase this year, according to the International Monetary Fund in its latest report published on April 17.

Growth in the next two years is not heartening either, with 2013 clocking a 2.8% growth and 2014 witnessing a 2.9% improvement, according to IMF estimates.

After exploding onto the front pages early last year, Bahrain's political crisis had taken a backseat to the more violent Syrian crisis and the political drama unravelling in Egypt over the course of the past 12 months.

But with Formula 1 set to return to Manama on the weekend of April 20 after being cancelled last year, all eyes have returned to the political developments in the country, and have discovered that little progress has been made.

Formula 1 chief Bernie Ecclestone didn't help by stating that "nobody's been shot" in Bahrain, further highlighting rather than distracting from the political events unfolding in the country.

While Bahrain is paying a huge human and political cost for the crisis, the economy is suffering too.

"We believe that the risk of a hard-line, more violent streak emerging from within the opposition than hitherto witnessed is rising," wrote Citibank in a note late in March.

Within the government, reform seems to have slipped down the agenda in deference to security issues, the bank notes.

"The reformist head of the Economic Development Board, a body that has been at the vanguard of economic reform in Bahrain over the past decade, was removed by Royal Decree in Mid-March. A close ally of the Crown Prince, Sheikh Mohammed bin Essa Al Khalifa has reportedly taken on a formal role as advisor to him.

With Sheikh Mohammed's departure, we expect the EDB to cease to lead on economic reform, and revert to its former role as an economic advisory body."

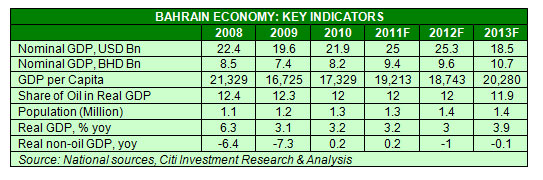

The government's estimates show the country grew by 3.2% last year, much rosier than the IMF's 2% growth forecast.

"Surprisingly, the main driver for this was the oil sector, which having shrunk over 2% a year over since 2003, suddenly posted a surge in output of 7.6%," noted Citibank. "Perhaps more predictably, the non-oil sector posted the weakest growth in a decade, at just 2.6% compared with an average of over 8% annual growth since 2002. While better than expected, growth is still below trend, and will remain so in the medium term in our view."

Source: IMF

The economy has been supported by Bahrain government's fiscal measures, which have stretched its finances. As part of its policy to contain the crisis, the government had decided to add 20,000 new government jobs, build affordable housing for a bill of USD5-billion and handout USD1,000 to each Bahraini family.

Later in the year, the government earmarked a further USD1 billion to raise government employee salaries.

The Bahrain Independent Commission of Inquiry (BICI), established by King Hamad bin Isa Al Khalifa and headed by the Egyptian-American jurist Cherif Bassiouni, issued its findings in November 2011.

Human Rights Watch says that the king promised at the time to carry out all of its recommendations and established a National Commission to monitor the process. That body reported on March 20, 2012, that the implementation of the BICI's recommendations had been "comprehensive and far reaching" and "touched all aspects of Bahraini life."

"Bahrain has taken some positive steps, but the Bahraini authorities can hardly claim that the BICI's recommendations have been implemented as long as hundreds of people remain behind bars solely for speaking out and demanding a change of government," said Joe Stork, deputy Middle East director at Human Rights Watch. "And it seems that no high-ranking officials have been investigated for their roles in rampant torture or unlawful killings."

BANKING WORRIES

The Bahraini government had carved a niche for the country's financial services sector in the region and honed it for decades to create a first-class regulatory environment.

However, the sector is suffering amid a wider economic downturn and the advent of far safer financial havens such as Dubai and Doha. The political crisis has not helped Bahrain's cause, but fears of a mass exodus of the banking fraternity have been largely unfounded, according to Central Bank of Bahrain figures.

Latest figures from the CBB newsletter show there were 417 financial institutions as at March, compared to 412 by the end of 2011.

As of February 28, there were USD198.7-billion of banking assets, compared to USD202.2 billion last October, while branches of foreign banks remained unchanged since last year. However, the offshore sector is characterised by limited participation in the domestic banking system and their domestic assets account for less than 10% of total assets.

The economic weakness is taking its toll on the country's banking sector.

Moody's, the ratings agency, warns there is a danger that political protest could return, which would be detrimental to the already fragile market confidence towards Bahrain and negatively impact Bahrain's economy and banking system.

"Aggregate non-performing loans (NPLs) for the largest retail banks will likely exceed 8% of gross loans by end-2012, from around 7.5% at end-2011," said Moody's in a statement on April 17.

Loans to real estate, small businesses, tourism and retail sectors - which account for nearly 21% of the country's GDP - are especially risky.

"These industries contracted over the first nine months of 2011, and Moody's expects that the ongoing social unrest will likely prevent a recovery to pre-crisis levels over the next 12-18 months," said the credit ratings agency.

This would decrease profitability for the major banks, however earnings will remain adequate to absorb "elevated levels of provisioning expenses."

It's fair to expect the government to step in, if any bank needs a bailout. That would certainly be true for National Bank of Bahrain, which is 49% owned by the Bahrain Government.

"Given the concentration of NBB 's activities in Bahrain, a deterioration in the local operating environment (in particular an escalation of the social unrest that commenced in Q1,11), could negatively affect the bank's VR, but this could also impact the sovereign rating," says Fitch ratings agency.

The bank's asset quality indicators, while relatively healthy (end-2011: non-performing loan (NPL) ratio of 1.8%), deteriorated somewhat owing to the unrest in 2011. A downgrade could occur if the negative asset quality trends witnessed in 2011 were to materially worsen.

Moody's also think that despite weakening asset quality and profitability, systemic risks will be mitigated by Bahraini banks' healthy liquidity and relatively strong capital positions.

"Moody's expects capitalisation levels to remain broadly stable as banks continue to absorb high provisioning expenses through their recurring earnings, whilst muted business growth opportunities imply that banks will likely not deploy any excess capital," notes the agency.

"However, Moody's highlights that the financial performance of Bahraini banks varies significantly, with some of the weaker, typically smaller, banks' solvency more vulnerable to any negative developments in the operating environment."

An implosion of the euro crisis could also negatively impact the banking sector. The onshore retail banking sector, European financing is a much higher 75% of GDP due to the sector's size but the mitigant here is that the banks show matched levels of foreign assets and liabilities.

However, in the long term, a sustained withdrawal of foreign funding would be a structural issue for all three countries, necessitating a change in strategy and any gap would pressure the local economy without new sources of funds.

Some Bahraini banks also have exposure to Arcapita, which recently filed for bankruptcy protection in the United States.

CONCLUSION

It's tough to be optimistic about Bahrain's economic outlook, before any of the political conflicts are resolved. At the moment, despite efforts by the government to reconcile differences, the stalemate continues as the opposition says the efforts are not sincere.

The matter is further complicated due to the overarching tensions between Iran and Saudi Arabia, which are purportedly being played out in Bahrain. The opposition groups steadfastly state that are grievances are home-grown and their motives not driven by any foreign elements.

Either way, both sets of parties have been unable to find enough common ground to start earnest negotiations.

© alifarabia.com 2012