Nigeria's vast economy has many moving parts - in fact 36 of them.

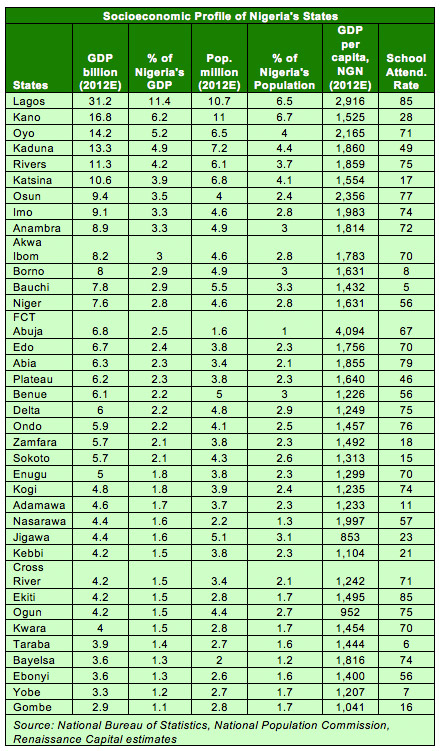

While most market observers see Nigeria as a homogenous nation and focus on the capital city of Lagos, the country has 36 states with their own economic dynamics and strong self-sustaining growth.

Some of Nigeria's states have economies bigger than other African countries, but they are still not on the radar screens of investors.

A new report on the county' states aims to shed light on some of the hidden economic dynamos in Nigeria.

"Back in the 1990s, investors discovered that Russia was not just Moscow and St. Petersburg," said Charles Robertson, chief economist at Renaissance Capital. "In the 2000s, investors began to hear about Chinese mega-cities beyond Beijing and Shanghai. This report aims to do the same for Nigeria."

Nigerian authorities do not breakdown economic growth by state so Renaissance has done its own financial modeling to offer the first state-by-state look at the Nigerian economy.

At USD 31 billion, the state of Lagos alone is bigger than the economy of Tanzania and is Africa's 13th largest economy, according to Renaissance Capital estimates.

Fitch Ratings recently upgraded the state's long-term credit rating to positive at AA.

"Fuelled by public and private investments, as well as an estimated population of about 20 million according to state officials, Lagos' diverse economy is the leading contributor to Nigerian GDP," said Fitch analyst Yvonne Tendai Masiku.

"Fitch expects the 10% growth in the local economy and the state's plans to widen the tax base and improve collection methods to boost local tax receipts towards NGN 330 billion (USD 2 billion) by 2015, up from NGN 200 billion (USD 1.26 billion) in 2012."

Beyond Lagos

Other states like Kano, Kaduna and Katsina in the northwest and Oyo in the southwest have GDPs exceeding USD 10 billion each.

With an economy of USD 17 billion, Kano state is the country's second largest business center and its economy is roughly the size of Botswana.

In Kaduna state, oil-related revenues account for about 70% of the state's income and are expected to gradually reach NGN 80 billion (USD 506 million) by 2015 from NGN 60 billion (USD 380 million) in 2011-12.

"Investment in projects such as power, transport, water supply, education [and] health could hover around NGN 35 billion (USD 22 million) per year over the medium term as the state's capital spending is largely driven by operating surpluses," said Fitch's Masiku. "Fitch expects Kaduna to fund about 5%-10% of capital spending with debt."

The Federal Capital Territory (FCT) of Abuja, however, is home to the country's richest people.

"FCT Abuja has per-capita income of circa USD 4,000, which is more than double the national average of USD 1,700," said Renaissance's Sub-Saharan Africa economist Yvonne Mhango.

"This implies Abuja's per-capita income is equivalent to that of Tunisia and Ukraine. The people of Lagos state are Nigeria's second wealthiest, with per capita income of USD 2,900, which puts it on par with Morocco and Sri Lanka."

Other states like the Akwa Ibom saw revenues of NGN 260 billion (USD 1.64 billion) in 2012, thanks to market oil prices at around USD 100 per barrel, offsetting fewer disruptions in oil production.

"The eventual full removal of the fuel subsidy and/or the likely replacement of the excess crude account (ECA) with revenues from the sovereign wealth fund (SWF) could help oil proceeds continue growing towards NGN 300 billion (USD 1.9 billion) by 2015, while maintaining the margin at 75%," said Fitch.

Despite non-oil GDP growing by about 10% in 2012, largely fuelled by state investments, Fitch expects Akwa Ibom's internally generated revenues (IGR) to continue to represent about 10% of revenue, or NGN 40 billion by 2015.

"This relatively low tax share of revenue is reflective of a small presence of private companies in the local economy, although Akwa Ibom is attempting to promote the creation of local corporations/SMEs and attract foreign companies through the construction of roads, hotels, a seaport and an airport and the implementation of investor-friendly laws."

Northbound growth

While the southern states have traditionally been the region's economic generators, the north is also rising.

Traditionally handicapped by their landlocked status, states in the northern region are also looking to improve their market access.

Nigeria's finance minister Ngozi Okonjo-Iweala recently noted that better roads and transport systems were crucial to achieving more regional integration and help northern states share some of the country's economic dynamism.

Nigeria's all-round growth presents plenty of opportunities for foreign investors.

"We think consumer companies are likely to find the greatest opportunities in states with greater purchasing power, as indicated by relatively high per capita income, including Lagos, the FCT Abuja, as well as Oyo, Osun in the southwest and Kaduna and Nassarawa (both next to the FCT Abuja), and the Niger Delta states," said the Renaissance Capital analyst.

"We see opportunities for banks to expand services and employees into states that have a combination of high income and population densities, as that will provide the footfall required to open a bank branch. States that fit this profile are Anambra, Imo and Abia in the SE region; Akwa Ibom and Rivers in the Niger Delta region; and Osun in the southwest."

© alifarabia.com 2013