Morocco's economic growth has faltered in recent quarters, with GDP growth slowing to 2.5% in the first quarter of the year mainly due to a decline in agricultural output and phosphate exports.

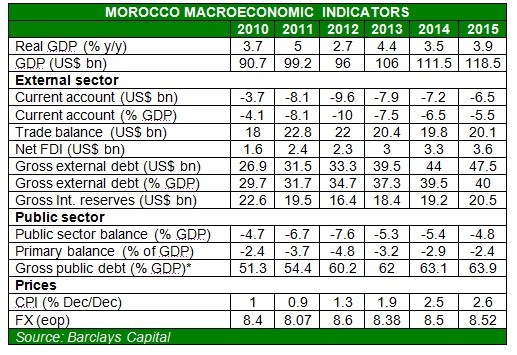

The country had registered GDP growth of 3.8% in the first quarter of 2013 and 4.5% in the last quarter of 2013. The country's state planning agency now expects GDP to grow 3.7% in 2015, lower than the 3.9% forecast by the International Monetary Fund in 2014 and 4.9% in 2015.

The lack of growth is worrying as Morocco implements painful subsidy cuts and a range of social and economic reforms.

"On the fiscal front, the challenge of fiscal consolidation amidst lower growth and higher oil prices will be difficult. Rising spending and falling revenue widened Morocco's overall fiscal deficit by 41.5% y/y to MAD 28.7 billion (USD 3.5 billion) in the first four months of the year," said Barclays Capital in a note.

"Total spending rose 11.5% y/y at end-April, bolstered by a 50.1% y/y expansion in capital expenditures, in line with the government's plan to support growth."

Spending on subsidies registered a 5.5% y/y decline under the reform initiative.

"While domestic demand continues to benefit from low inflation, the recent increase in oil prices, and rebound in unemployment in Q1 14 (10.2% up from 9.5% in Q4 13), as well as the reduction in rural income, could add downside risks to consumption growth during the rest of the year,"

Agricultural output growth fell to 3.4% year-on-year after registering double-digit expansion in 2013. Exports of phosphates and its derivatives fell 13% during the first quarter, largely offsetting overall growth of 10.2% year-on-year largely driven by the exports of cars, electronics and aeronautics.

The higher planning commission also foresees downward pressure on growth from an expected slowdown in construction and industrial investment.

IMF credit

The country survived the Arab Spring chaos by embarking on significant political reforms, which kept dissent at bay. But it has not reaped the rewards of social and political reforms and the authorities are now seeking a credit lifeline.

Morocco is reportedly seeking a new two-year precautionary line of credit (PLL) with the IMF, which may be potentially lower than the earlier USD 6.2 billion facility that expires in August.

The PLL has helped Rabat secure loans at favourable terms, such as EUR1 billion in a 10-year Eurobond last month at a yield of 3.7%.

Along with state-owned OCP Group's USD1.55 billion loan to fund its phosphate production, the country has also made use of aid from bilateral and multilateral donors, and has largely secured its external financing needs for the next six months, Barclays notes.

New avenues of growth

With Morocco's largest trade partner, the European Union, struggling, Rabat is looking at the fast-growing Sub-Saharan markets, according to Abdellatif Jouahri, governor of the central bank.

In addition, the country has opened up to Islamic finance to attract Gulf investment. An Islamic finance bill was passed last month by Moroccan lawmakers, paving the way of new investment in the financial services sector.

Morocco is also developing plans for solar power energy and for the offshore oil and gas sector as it expands its horizon to jumpstart growth.

The International Monetary Fund said promoting stronger, more inclusive growth and higher employment is the key challenge. It said that in order to improve competitiveness and reduce unemployment, there was also a need to accelerate structural reforms aimed at further improving the business climate and economic governance by enhancing transparency, accountability, and the rule of law.

The feature was produced by alifarabia.com exclusively for zawya.com.

© Zawya 2014