Nobody even considered looking at MENA states last year, as news of Arab Spring-related crisis, instability and the Iran conflict dominated the headlines.

But buried amid the negative headlines was the regional governments' resolve to continue pumping funds into their respective economies.

That strategy appears to have paid off, combined with a sustained bout of higher crude prices, which has raised fiscal and current account balances for most of the oil-rich Gulf states.

Bank of America Merrill Lynch (BAML) says there are four reasons for the improved business sentiment:

First, global central banks have resorted back to pumping liquidity, and the outlook in the United States and Eurozone - which has a significant impact on the MENA business cycle - has relatively improved. BAML's house view is that the third tranche of quantitative easing from the U.S. Federal Reserve remains on the table as there are likely to be strong headwinds to US growth in the second half of the year.

Second, fiscal policies remain accommodative in the region and, besides the permanent current spending measures implemented in 2011, capital spending and capital injections are increasingly likely to trickle down, particularly in Saudi Arabia. This is likely to give a domestic push to regional economic activity.

Third, higher oil prices and a regional budget breakeven oil price still at USD80/bbl give oil exporters room for even further stimulus, if need be. Year-to- date $20 increase in oil prices has added some USD72bn and USD104bn in total to fiscal and current accounts receipts (6.8% of GDP and 9.8% of GDP respectively) in Saudi, Qatar and UAE.

OIL PRICES

BAML believes that an unlikely shutdown of the Strait of Hormuz could send oil prices spiralling to USD100 above current prices, i.e. around USD224 per barrel for Brent.

A more realistic scenario is oil prices hovering close to their all-times high of USD147 per barrel.

"Simply on a liquidity or demand driven rally, we believe prices could briefly cross USD140/bbl and flirt with previous record levels, should EM demand for oil improve over the next few months against a constrained supply environment," says BAML.

But that could trigger a 'violent' sell off, creating a credit episode in oil-importing economies, with Eurozone nations especially vulnerable.

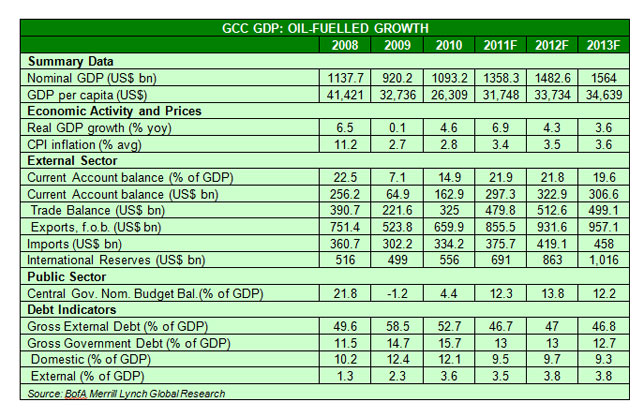

REVISED GDP FORECAST

But BAML believes the world economy will escape disaster.

The bank has revised upwards its forecast for Gulf economies from 3.4% in 2012 to 4.3%, with Saudi Arabia expected to clock in a 5% growth, which is far more conservative than other analysts.

In a note in late March, Barclays Capital forecast growth of 5.4% for the Gulf States, with Saudi Arabia expected to under-perform the region with a 5.1% growth.

Meanwhile, Citibank is extremely bullish on Saudi Arabia with a 7.1% growth forecast in 2012.

While the figures of various Wall Street banks may diverge, all indicators seem to be pointing upwards, on balance that events unravelling in the region are largely beneficial for the economies.

"On net, 2011 events provided a tailwind to GCC macro with fiscal stimulus, higher production to compensate for Libyan output losses, higher oil prices (region-wide) and diverted financial and tourism flows (Dubai-specific).

"Iran-related tensions translate for now into higher oil production (largely Saudi-specific) and elevated oil prices. In the event regional geopolitical concerns do not materialize but do not dissipate totally either, keeping a risk premium into oil prices, we expect GCC to grow robustly - headwinds would instead gather in EEMEA fuel-importing countries with large funding needs, we think," notes BAML.

SAUDI IN 'SWEET SPOT'

BAML expects Saudi GDP to rise significantly, especially after it raised oil price forecast to USD118 per barrel. That would translate into a 15.5% GDP surplus for the Kingdom and a six per cent rise in spending.

The Kingdom's other economic indicators also point towards an upswing. Consumer and business confidence data such as PMI and point of sales transactions have shown robust growth and construction data has also picked up.

"Banks have continued to draw down their excess reserves in 2012 after a large reversal late 2011. Credit to the private sector was up by 12.1%yoy in February, the highest since April 2009," notes BAML. "Nevertheless, credit by specialized funds continues to be made available, and is likely to accelerate in 2012 on the back of the large capital injections into real estate, credit funds or the Housing Authority in our view."

Then there is the SAR70bn allocated to the Saudi Real Estate Development Fund and Saudi Credit and Savings Bank that's set to trickle into the economy. The 'better quality' of spending will further boost the economy over the long term.

Finally, the government's spending spree will continue unabated with gross capital fixed formation, led by construction sector, driving growth.

UAE: IRAN IMPACT

The UAE's economic situation has also improved, but remains vulnerable to a host of factors.

"Bahrain, Iranian standoffs could increase regional geopolitical risks. A prolonged drop in oil prices, a deteriorated G3 outlook, a drying out of UAE exports to Iran, unpleasant surprises in Dubai Inc. restructuring and hampered market access to external finance would hurt the macro outlook."

Nevertheless, there has been a sea-change in UAE's macroeconomic data since the troubled days of 2008-2010. In fact, BAML notes that the UAE can absorb the fallout from sanctions on Iran.

The Islamic Republic accounts for 6% of total and 12% of non-hydrocarbon UAE exports. While previous sanctions on Iran have had little impact on trade between the two nations, the new set of sanctions may have a much greater impact.

"It is difficult to quantify the impact of financial restrictions and obstacles in obtaining trade finance on existing Iranian businesses operating in Dubai. We estimate that, in the worst case scenario where all exports to Iran stopped, UAE GDP would be reduced by just 1.4% (assuming 20% added value for re-exports)."

However, Dubai remains vulnerable to an interruption in oil supplies from the Strait of Hormuz.

"A squeeze on oil income in the GCC would most harshly (indirectly) affect Dubai given its low level of savings, leveraged banking sector and resultant lower liquidity complicating the refinancing of the large maturities coming due in 2012," notes BAML.

QATAR'S REMAINS INSULATED AS LONG AS STRAIT'S OPEN

Qatar is expected to generate a 6.1% growth in 2012, according to BAML estimates, with the few major risks of the country unable to export LNG due to a Strait of Hormuz shutdown or a global macroeconomic meltdown.

Luckily, the country is rather insulated from a fall in spot prices for gas, as 50-55% of its exports are locked in 20-year contracts. In addition, most Asian and European markets are linked to crude prices, unlike North America where gas prices are a fifth of those in other markets.

And with LNG production plateauing, the private sector seems to be stepping up to the plate.

"Credit growth [in Qatar] has far outpaced its GCC peers with total loans growing by 31%yoy in February. However, unlike a year ago, loan growth is no longer driven mostly by the public sector, largely funded in turn by public or private "quasi-public" deposits. Corporate and consumer loan growth is robust, the latter likely receiving some support from the recent increase in public sector wages."

ISRAEL-IRAN CONFLICT?

Is Israel retreating from its threat to unilateral attack at Iran's alleged nuclear installations?

It appears so.

BAML expects the Israeli-Iranian tensions to continue to fester as the Iranian regime appears determined to pursue nuclear weapon if only to derive domestic support and legitimacy.

Meanwhile for Israel, the unfavourable economics of a conflict and its logistical challenges may prevent it from using military force in the ongoing standoff.

International negotiations with Iran are likely to start in mid-April while the recent reappointment of Rafsanjani as head of Iran's Expediency Council may mean a route for compromise could still remain open, says BAML.

"The start of negotiations would also likely mean Israeli military action is less likely, all things being equal. It is unclear if and when such a compromise would be reached but, at any case, U.S. and EU sanctions are now getting underway and are unlikely to be reversed in the short-term consequently."

CONCLUSION

With oil prices showing no signs of abating, the outlook remains rosy for the Gulf states.

With higher global liquidity, supportive fiscal policies, and elevated oil prices may continue to support growth this year in the absence of deterioration in geopolitical risk.

"While there are still some downside risks to global growth, we believe that MENA is now even better positioned to cope with such a slowdown given the increased oil windfall," says BAML.

ALSO READ: Saudi Arabia: Jobless Growth?

Optimism Over UAE: Barclays Capital

© alifarabia.com 2012