The Islamic asset management industry has experienced remarkable growth over the past decade. From the structuring and launching of funds it has evolved towards a more comprehensive wealth management service.

Despite the growth, the industry hasn't focused yet on defining a proper asset allocation framework for Islamic investments. Historically, the Islamic portfolio approach has been mainly "return driven", paying less attention to the risk and liquidity profile. The lack of some clusters may have justified this. Increasing allocation to sukuk, the selected use of Shariah-compliant derivatives and a risk parity approach to asset allocation can represent the base for a more effective Islamic portfolio management.

Over the past 10 years, the Islamic funds industry has grown to USD 60 billion at the end of 2011, with an annual increase of circa 4%. The outlook is still bright considering that the potential demand is at least 10 times bigger than the current size of the industry.

Over this period Islamic asset management experienced three main important trends: (a) an increase in the number of funds offered to investors (over 800 funds); access to a wider number of asset classes and strategies; and (c) the evolution of the business model from a simple offering of funds to a more comprehensive wealth management service.

Despite the significant growth, the industry hasn't focused sufficiently on identifying an appropriate framework for asset allocation of Islamic investments. The development towards a more comprehensive wealth management approach to Islamic portfolios and the consequences of the recent financial crisis highlighted the need for a more effective asset allocation to Islamic investments.

Historically, Islamic portfolios have been skewed towards alternative investments (in particular real estate and private equity) and local/regional equities. Reasons can be indentified in the intrinsic nature of Islamic investing with the preference for tangible assets, the absence, for a long time, of some clusters (the fixed-income component) and the "return driven" approach to investment (focusing only on the IIRR).

This allocation ended up creating a sort of "skewed Yale model" incorporating high liquidity and risk premiums that, in many cases, haven't been addressed properly at the time of the investment. During the 2008 financial crisis numerous have been the requests from investors for asset monetization, resulting sometimes in challenging missions due to the nature of their portfolios. Apparently, HNWIs and institutions have learned the lesson and they started to assess the portfolio allocation with a more risk and liquidity adjusted approach.

How Can Islamic Asset Allocation Be More Effective?

Sukuk instruments, which experienced a significant development over the past few years, can play an important role in building more efficient solutions. In 2009, the HSBC/DIFC Sukuk Index included 16 international sukuk; today the index includes 45 with better credit profile, sector and maturity mix.

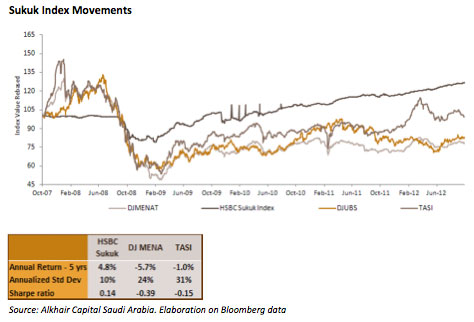

In parallel, liquidity in the secondary market showed significant improvement and few sukuk-dedicated funds have been launched. Sukuk should have a more pivotal role in Islamic asset allocation, representing the first step of building the investment process. Over the past five years, sukuk have provided a better risk-return profile than other asset classes, outperforming local and regional equities as well as commodities.

Since 2010, the volatility of the sukuk market (measured by the 30 days volatility) dropped significantly below 2%, resulting in a less risky investment compared to other asset classes. A sukuk allocation in Islamic portfolios indeed reduces the overall volatility, provides an income stream and represents also a more suitable collateral instrument for leveraging returns (comparing to real estate or private equity).

Proceeds from the leverage can be allocated to other asset classes via cash exposure or Shariah-compliant derivatives. Portion of sukuk coupons can be utilized to buy "optionalities" on specific asset classes (equity indexes, basket of Shariah-compliant stocks, ETCs, etc.). Even if initially opposed, there is now more of a consensus among Shariah scholars in accepting the use of some derivative structures when the purpose is not speculation but providing upside potential to an asset class with downside protection. The use of simple and clear structures and full transparency to investors are the most important elements for a successful portfolio implementation.

The more strategic role of sukuk investments in the Islamic portfolio-building process, the "natural" tendency to use leverage among many investors in the Arab region, the need of a less "return driven" approach in favor of a more effective risk management overlay, appear complementary to the implementation of a risk parity approach to Islamic asset allocation.

The central idea of the risk parity approach is that in a well-diversified portfolio, all asset classes should have the same marginal contribution to the total risk of the portfolio. Initially implemented in the late nineties, the theory has found more ground with the recent financial crisis since the traditional portfolio approaches (like mean variance optimization) haven't provided satisfactory results in preserving investors wealth, according to Thiagarajan S.R. and B. Schachter, writing in The Journal Of Investing.

Since error estimate in return calculation is higher than in volatility calculation, the approach focuses on the risk allocation. In a traditional portfolio approach the "base case" allocation is usually 60% equity and 40% fixed income but, in reality, the equity components account for 90% of the overall portfolio volatility.

Rebasing the allocation looking at the marginal risk contribution can generate an improvement in the overall portfolio Sharpe ratio. Islamic finance may have the chance, one more time, to be on the cutting edge of financial innovation.

Marco Mauri is senior director of asset management at Alkhair Capital Saudi Arabia. He overlooks client portfolios' asset allocation, alternative investments, sukuk and international equity markets.

This article was part of Zawya's Funds Monthly Insight, November 2012 issue.

© Zawya 2012