PHOTO

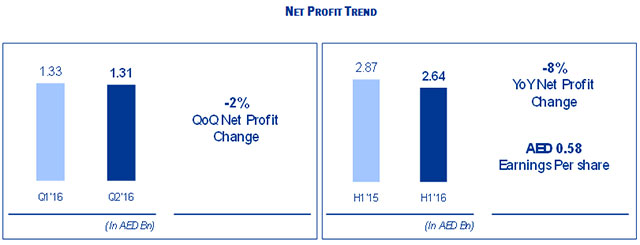

Net Profit reaches AED 2.64 Billion in First Half 2016

- Second quarter Group Revenue up 3% sequentially; Second quarter Group Net Profit of AED 1.31 Billion, compared to AED 1.33 Billion for the previous quarter

- H1'2016 Group Net Profit of AED 2.64 Billion, compared to AED 2.87 Billion for the first half of 2015; First Half 2016 Earnings Per Share at 58 fils against 62 fils for the same period last year

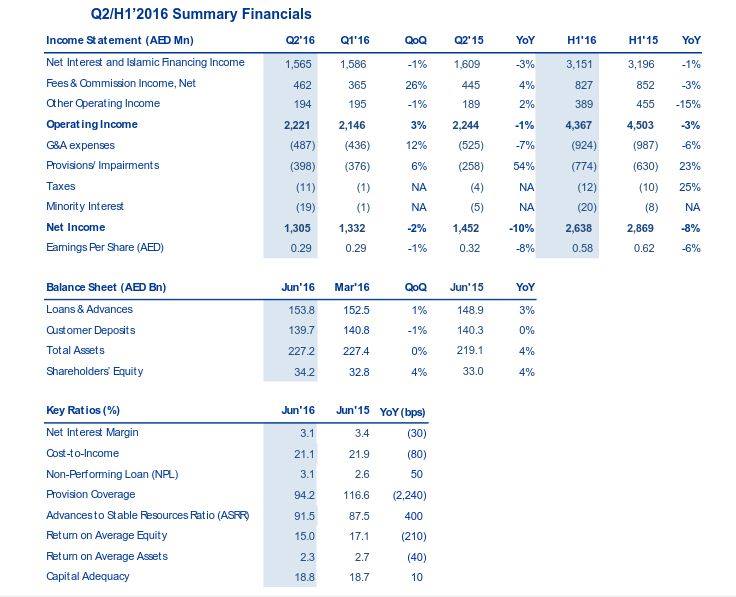

- Comfortable liquidity position well within regulatory requirements: Advances to Stable Resources Ratio at 91.5% and Liquidity Coverage Ratio above 70%

- Key balance sheet indicators: Total Assets of AED 227.2 Billion, Loans and Advances of AED 153.8 Billion, Customer Deposits of AED 139.7 Billion, and Shareholders' Equity of AED 34.2 Billion

- Disciplined cost management with General & Administrative Expenses down 6% Year-on-Year and Group Cost to Income Ratio at an industry-leading level of 21.1%

- Other key ratios well within management guidance: Net Interest Margin at 3.1%, Non-Performing Loan ratio at 3.1%, Provision coverage ratio at 94.2%

- Robust capital position with total Capital Adequacy Ratio at 18.8% and Tier 1 Capital ratio at 17.5%

- FGB credit ratings affirmed at A2/A/A+ by Moody's/S&P/Fitch. FGB's long term rating outlook changed to "Positive" from "Stable" by Moody's

Abu Dhabi, July 27, 2016

FGB, one of the leading banks in the UAE, reported second quarter 2016 Group revenue growth of 3%, while Q2'2016 net profits were recorded at AED 1.31 Billion compared to AED 1.33 Billion for the previous quarter. FGB reported a Group net profit of AED 2.64 Billion for the six-month period ended 30 June 2016, compared to AED 2.87 Billion for the first half of 2015. Earnings per share for the first half of 2016 stood at 58 fils against 62 fils in the first half of 2015.

Commenting on the results, André Sayegh, CEO of FGB said: "During the second quarter, we generated a Net Profit of AED 1.31 Billion, a good performance amidst global operating challenges, demonstrating the fundamental strength of our business model. These results were achieved on the back of an enhanced model across our businesses, geared to support higher profitability in the medium to long term, and create sustainable value for our shareholders.

In line with our strategy to preserve a strong balance sheet and solid ratios, the three key priorities we are focusing on in 2016 are enabling us to successfully navigate current operating conditions while positioning us well for future growth. These focus areas include: prudent lending through selective origination, ensuring adequate liquidity, and maintaining disciplined resources allocation. Measures taken to deliver on these priorities allowed us to protect our returns, reduce our funding costs sequentially and attract more deposits from our international locations, as well as sustain industry-leading operating efficiency."

Sayegh added: "Our quick and determined action to adapt to new operating conditions was accompanied by our relentless focus on increasing penetration and gaining market share in key product lines at home and also across our international locations where we saw positive momentum. As a result, we are ending the period with a solid foundation and an enhanced capacity to generate healthy and balanced revenues across core business lines in a sustainable manner; as proven by the revenue increase achieved during the second quarter."

During the period, FGB's credit ratings were affirmed at A2/A/A+ by Moody's/S&P/Fitch. In addition, Moody's changed FGB's long term rating outlook from 'stable' to 'positive'. This rating action followed the official public announcement on July 03, 2016 that FGB and National Bank of Abu Dhabi (NBAD) have entered into a merger agreement.

In recognition of the bank's commitment to develop innovative products and services for its customers, FGB received a number of prestigious accolades during the period including: 'Best Co-branded Credit Card', 'Best Onshore Wealth Proposition' 'Best SME Trade Finance Offering' and 'Best Bancassurance Product' from the 2016 Banker Middle East UAE Product Awards. FGB's Ferrari card was also recognised as the 'Best Premium Credit Card' at the 2016 Smart Card and Payments Awards and the bank was presented with three awards by IJ Global and PFI Finance for its successful role in several major transactions.

Note: Rounding differences may appear in the above table

Outlook

Sayegh concluded: "We are mindful of a range of global macro-economic challenges affecting investor sentiment, including the UK's decision to leave the European Union. Within this global context, we are fully confident that the UAE is resilient, powered by a strong and dynamic domestic economy and a unique and visionary leadership to spur economic diversification plans across the country. As recently indicated by the International Monetary Fund, economic growth is projected to improve in the medium-term as enhanced liquidity, a pick-up in private investment and stronger external demand restore investor confidence. With our dynamic strategy in place, we are confident in our ability to capitalise on future opportunities both at home and abroad. We are very well positioned to meet the evolving needs of our customers and we will continue to deliver on our long term sustainable returns to our shareholders."

-Ends-

FGB - NBAD merger

On 3 July 2016, First Gulf Bank PJSC (FGB) and National Bank of Abu Dhabi PJSC (NBAD) announced that their Boards of Directors voted unanimously to recommend to shareholders a merger of the two Abu Dhabi-listed banks.

The proposed merger will create a bank with the financial strength, expertise, and global network to support the UAE's economic ambitions at home and drive the country's growing international business relationships.

The combined bank will create a leading bank in the region, based on Q1 financials both entities have AED 642 billion (US$175 billion) of assets and a combined market capitalisation of AED 106.9 billion (US$29.1 billion). It will be the leading financial institution in the United Arab Emirates (UAE), with a 26 percent share of outstanding loans, and will operate an international network of branches and offices spanning over 19 countries. Both entities will continue to operate independently until the merger becomes effective, which is expected in the first quarter of 2017.

The proposed transaction is a merger of equals and will be executed through a share swap, with FGB shareholders receiving 1.254 NBAD shares for each FGB share they hold. Following the issue of the new NBAD shares, FGB shareholders will own approximately 52 percent of the combined bank and NBAD shareholders will own approximately 48 percent. The Government of Abu Dhabi and related entities will own approximately 37 percent. On the effective date of the merger, FGB shares will be delisted from the Abu Dhabi Securities Exchange.

The combined bank will retain NBAD's legal registrations and the brand name of "National Bank of Abu Dhabi". Its Board will include four nominated directors of FGB and four nominated directors of NBAD. His Highness Sheikh Tahnoon Bin Zayed Al Nahyan, who is currently Chairman of FGB, is the Chairman designate. His Excellency Nasser Ahmed Alsowaidi, who is currently Chairman of NBAD, is the Vice Chairman designate, and Mr. Abdulhamid M. Saeed, who is currently Board Member and Managing Director of FGB, is the Chief Executive Officer designate for the combined bank.

The merger is subject to a number of conditions, including the approval of the merger by at least 75 per cent by value of the shares represented at quorate general assembly meetings of FGB and NBAD. The merger is also subject to receipt of all required regulatory approvals.

For more information, please visit www.bankfortheuae.com

About FGB

As a major leading bank in the UAE, FGB had Shareholder Equity of AED 34.2 Billion as of June 30th, 2016 making it one of the largest equity based banks in the UAE. Established in 1979 and headquartered in Abu Dhabi, the bank offers a full range of financial services to business and consumer sectors through a network of branches across the UAE. Internationally, FGB has branches in Singapore and Qatar, representative offices in India, Hong Kong, United Kingdom, Seoul- South Korea and a subsidiary in Libya.

FGB is recognised as a world-class organisation committed to maximising value for shareholders, customers and employees as it focuses on delivering banking products and services that meet client needs and support the UAE's dynamic economy. In line with its commitment to excellence the bank continues to invest significantly in people and technology to provide superior service standards.

For more information

Visit FGB's corporate website: www.fgbgroup.com

Download FGB's Investor Relations app: https://www.myirapp.com/fgb/

Contacts

For analyst and investor enquiries

FGB Investor Relations Department

ir@fgb.ae

For media inquiries:

Jennifer Cain

+ 971 55 4741105

JCain@webershandwick.com

Hiba Haddad

+ 971 56 1679577

hhaddad@webershandwick.com

© Press Release 2016