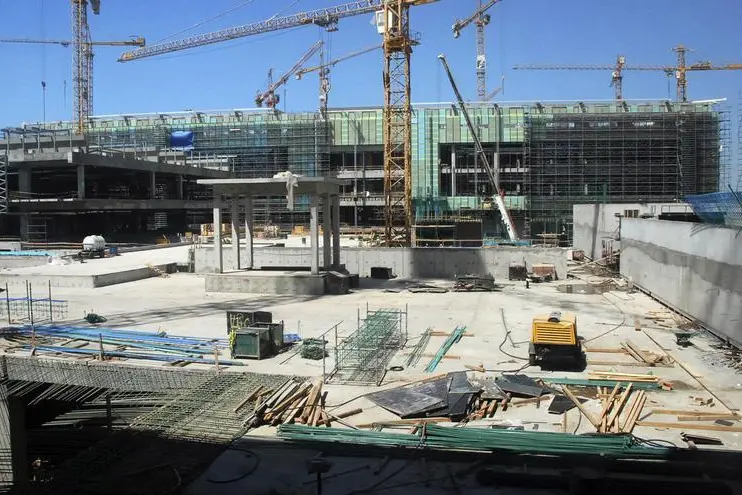

PHOTO

By Hadeel Al Sayegh and Tom Arnold

DUBAI, March 22 (Reuters) - Saudi Binladin Group's (SBG) creditors have agreed to extend by two years a 4 billion riyal ($1.1 billion) Islamic credit facility to pay for building work at the Kingdom's Grand Mosque in Mecca, banking sources said.

SBG, historically one of the heavyweights of the kingdom's construction sector, has been struggling because of delayed payments from the government. Its plight has eased since the start of the year after the government settled some of that debt.

Creditors have signed documentation to extend by two years 4 billion riyals of the total 10 billion riyals of a facility it had drawn down, the sources said. The credit would be extended from the end of 2017 to the end of 2019.

The loan will now have a similar timeframe to the completion of the mosque project, which has been delayed to allow the Saudi government to defer some of its spending plans.

The facility will carry a profit rate of about 7.5 percent, sources told Reuters.

Nobody was immediately available to comment from SBG.

The company has been involved in many major infrastructure developments in recent years, but like other contractors it has been hit by a stalling of projects and delayed payments as the government has curbed spending due to weaker oil prices.

Dubai Islamic Bank was the lead bank on the facility, with the other banks mainly United Arab Emirates-based including Emirates NBD and Noor Bank, the sources said, with one adding that Ajman Bank, Union National Bank and Mashreq were also involved. ($1 = 3.7498 riyals)

(Editing by Elaine Hardcastle) ((Tom.Arnold@thomsonreuters.com; +97144536265; Reuters Messaging: tom.arnold.thomsonreuters.com@reuters.net))

DUBAI, March 22 (Reuters) - Saudi Binladin Group's (SBG) creditors have agreed to extend by two years a 4 billion riyal ($1.1 billion) Islamic credit facility to pay for building work at the Kingdom's Grand Mosque in Mecca, banking sources said.

SBG, historically one of the heavyweights of the kingdom's construction sector, has been struggling because of delayed payments from the government. Its plight has eased since the start of the year after the government settled some of that debt.

Creditors have signed documentation to extend by two years 4 billion riyals of the total 10 billion riyals of a facility it had drawn down, the sources said. The credit would be extended from the end of 2017 to the end of 2019.

The loan will now have a similar timeframe to the completion of the mosque project, which has been delayed to allow the Saudi government to defer some of its spending plans.

The facility will carry a profit rate of about 7.5 percent, sources told Reuters.

Nobody was immediately available to comment from SBG.

The company has been involved in many major infrastructure developments in recent years, but like other contractors it has been hit by a stalling of projects and delayed payments as the government has curbed spending due to weaker oil prices.

Dubai Islamic Bank was the lead bank on the facility, with the other banks mainly United Arab Emirates-based including Emirates NBD and Noor Bank, the sources said, with one adding that Ajman Bank, Union National Bank and Mashreq were also involved. ($1 = 3.7498 riyals)

(Editing by Elaine Hardcastle) ((Tom.Arnold@thomsonreuters.com; +97144536265; Reuters Messaging: tom.arnold.thomsonreuters.com@reuters.net))